Atif Z. Qadir, AIA is the Co-founder & Chief Impact Officer of Commonplace, a market network at the intersection of real estate and capital markets. He is a Registered Architect and LEED Accredited Professional turned entrepreneur with a particular interest in housing and impact. His strengths are observing, asking, analyzing, and using the power of narrative to uncover, share, teach, support, advocate and champion. He is a builder at heart, who is comfortable in different scales and settings – from small workforce housing units to multi-billion dollar redevelopments, from podcasts and panels to public service, from nonprofits and academia to private equity & venture capital backed companies, and from design to finance to public policy.

Atif is also a Founder & Partner at Amanat Properties and serves on the Planning Commission in the City of Hoboken, the Advisory Council of Provident Bank and on the Board of Trustees of The Hudson School. He previously worked at Extell Development and Turner Construction. He began his career at Rafael Viñoly Architects and Boston Housing Authority. He studied at MIT, where he received dual bachelor’s degrees in Architecture and in Urban Planning, and at Columbia Business School, where he received a MBA focusing in Finance.

His work has been covered by MIT Technology Review, Commercial Observer, Propmodo, and The Real Deal. He’s also a frequent speaker on the future of buildings and cities on popular industry podcasts and at conferences, including this past year at the Commercial Observer National Diversity & Inclusion Forum, Yale Alumni in Real Estate Association Conference, the Columbia Real Estate Symposium, NYC Open Data Week NYC and Austin Design Week.

Read the podcast transcript here

Eve Picker: [00:00:04] Hi there. Thanks for joining me on Rethink Real Estate. For Good. I’m Eve Picker and I’m on a mission to make real estate work for everyone. I love real estate. Real estate makes places good or bad, rich or poor, beautiful or not. In this show, I’m interviewing the disruptors, those creative thinkers and doers that are shrugging off the status quo in order to build better for everyone.

Eve: [00:00:39] Atif Qadir is a serial entrepreneur, but that’s not where he started. Trained as an architect and urban planner. Atif decided pretty early on that what he wanted was to work his way up the ladder from servicing developers as an architect or builder to being one. So, he started developing his own small properties. And as his frustrations with finding project financing grew, so did his entrepreneurial ideas. He launched Commonplace, a fintech platform with a mind to create a marketplace for emerging developers and investors. Dating for development projects. In amongst all of this and in partnership with the Office of Michael Graves, Atif hosts a podcast show called American Building. He’s a high energy guy. You’ll enjoy listening in.

Eve: [00:01:40] Hey, Atif, it’s really good to have you on my show today.

Atif Qadir: [00:01:44] Thank you so much for having me on, Eve.

Eve: [00:01:46] Oh, yes. It’s going to be fun! So, you have a very multifaceted resume, lots of fingers in many pies, but your background is fundamentally architecture and planning. And then you went on to get an MBA at Columbia. What prompted you to transition from a registered architect to entrepreneur?

Atif: [00:02:08] Sure. So, the job that I had before going to business school was at Turner Construction, doing construction management for huge projects in the New York area. And for me, I had thought that going from architecture to construction was higher up in the food chain about actually be making decisions. When I realized that as a construction manager for a developer, I still wasn’t making any decisions. I was executing on decisions, but I was telling the architect what to do. So I sort of had moved up in the food chain but not quite to the the decision making power center yet. So, I knew there was a few more steps I had to go.

Eve: [00:02:45] And what was the top step you were attaining to acquire.

Atif: [00:02:51] At that point? I think it was being a developer, but then not to bury the lead, I realized that even being a developer is not the top of the food chain because now you’re answering to the investors, so, and the bank most importantly.

Eve: [00:03:02] Always the banks, always the banks, right? But anyway, you can definitely, as a developer, you have more control over more aspects of the project, right? Not just, and that’s a lot more fun, right?

Atif: [00:03:14] I think it’s a lot more fun. I would say the way that I describe being a developer in the context of, say, jobs or roles that are easily understood is I think a developer is a lot about being a project manager, an accountant, a janitor, a babysitter, a therapist, a divorce lawyer. Like all of those things is all the skill set of being a developer.

Eve: [00:03:38] Well, I would add artist to that.

Atif: [00:03:40] Oh, yeah, yeah! Artist, of course, yeah. Sometimes it’s easy to forget that one.

Eve: [00:03:45] You’ve got to use that side of your brain to really envision things, right? If you’re going to do a good job of it, right?

Atif: [00:03:51] Of course. Yeah. I think that there’s this great quote that I saw on LinkedIn. There’s a gentleman named Tyler Sumaila who does coaching for architects about how to think and how to present themselves the value that they bring. And I think there’s a lot of similarity between what we’ll say for architects and developers. Basically, it says teaching an architect is like teaching a baker how to bake every bread that’s ever been made before and how to make every bread that could potentially be made in the future and not teaching them how to run the bakery. That’s essentially what an architect does.

Eve: [00:04:25] Actually a pretty good analogy. Yeah.

Atif: [00:04:27] And feel developers are maybe like a shade similar to that too.

Eve: [00:04:30] That’s true, that’s true. So, I’m going to explore three of your companies. They were the only three I could find so far.

Atif: [00:04:38] I’ve tucked to a few more into the side.

Eve: [00:04:40] If there’s a few more just let me know, okay? But the first is Amanat Properties, which is perhaps the most traditional of your companies. That’s your development company, right? And what type of projects do you focus on and where are they?

Atif: [00:04:54] Sure. So, it’s in the Garden State, the great state of New Jersey, and the types of work that I do is historic redevelopment on a small scale. So, these are the projects that completed are a rental building in Hoboken where I live, and a condo building as well. And then I also have a workforce housing portfolio of 13 different assets that are, I purchased them as Class C and then brought them to Class B with renovation. And those are in Hudson and Middlesex County in New Jersey, which is the I-95 corridor.

Eve: [00:05:30] Oh, okay. And what drew you to this niche?

Atif: [00:05:33] So I would say from a few different perspectives. One is from the geography perspective, once I moved to New Jersey after business school, I realized there’s this whole amazing place called New Jersey and Hoboken and Jersey City in particular is the half price clean version of Brooklyn. And I was like, there’s so much value, so much value there. So that was I think the geographic reset was really important. I think number two was having spent a couple of years at Extell, I realized that at a very prominent real estate development firm like that and perhaps others, there’s a glass ceiling that you come to. And of course, it’s based on gender. But there’s another layer, of course, on that, which is if you’re not the family member of the founder of the company, there is a limit to how far you can go. And in this particular situation, Gary Barnett, the owner of Extell, very intelligent, very prolific developer. All of his daughters were already married so there was really no option for me to join the family at that point. So, I started considering the other options.

Eve: [00:06:43] Was that your way in, marrying a daughter?

Atif: [00:06:45] I would be so good as a house husband. I would kill it as a house husband. But unfortunately, that route wasn’t available. So that was the second thing kind of draw out. And I would say in particular, when it comes to fixing, I’ve realized over the course of my career that my nature is actually very much more a fixer and a bringer together and a resolver than my nature is as an executor as opposed to a creator. So, for me, I actually enjoy the idea of historic redevelopment significantly more than vacant land. So, I think all those reasons were the influences that brought me to do development the way I described it to you.

Eve: [00:07:28] And so what are the unique challenges that you faced?

Atif: [00:07:32] Yeah. So, I think the most often thing, when ask this question to other developers, it’s how much time do you have?

Eve: [00:07:39] Go, go for it.

Atif: [00:07:42] Go for it, do it. I would say, the three that I would say come to mind right away, number one would be access to capital. So, I think that for me, for my deals, I had probably done a hundred tours of Hoboken and Jersey City to raise $8 million from a small handful of investors. And then I talked to 35 banks to get the debt that I needed for my two development projects. And I still ended up having to use a mortgage broker.

Eve: [00:08:13] And why do you think that is? Why is it so hard?

Atif: [00:08:16] I think that fundamentally it boils down to this issue of a supply and demand mismatch. And I think at the smaller level, there is an array of potential investors, but none of them are institutional level and being able to actually find them and find them at the time that they have the money to give to you is really like the whack-a-mole challenge.

Eve: [00:08:39] It’s a huge challenge. So, you’re talking about what I call the $10 million check problem, right?

Atif: [00:08:44] 100%. I was just talking to Caleb Ratinetz, who’s a principal at Asland Capital Partners. So, a mid-size equity provider for residential inclusive of affordable housing. And he’s like, asked me like, why wouldn’t you invest in projects where you’re cutting checks of three, 4 or 5 million? He’s like, why? They’re bigger headache than me for like a $10 million check and even a $10 million check is a headache.

Eve: [00:09:09] Which is a really big problem because that means that emerging developers, disinvested neighborhoods, all those things that you and I probably care about get left behind because I think that gap is widening and widening. It’s not, it’s probably no longer $10 million and it’s probably creeping up to $15 million.

Atif: [00:09:27] I think it’s inflation is now like 30% a year.

Eve: [00:09:31] So that’s a huge problem. And has that slowed you down in the projects that you’ve been able to? Well, of course it has.

Atif: [00:09:41] Come to think of it like this, is that if it took me, so 2018 is when I acquired title to the two properties and both of them were stabilized by the spring of 2020. So, it was two full years to do two projects that were under $5 million each. I just like, imagine the amount that I could have done. I could have done eight townhouses or like eight small multifamily buildings in that time if I wasn’t running around doing the dog and pony show for investors and for lenders. So, I think the volume of stuff is definitely what ends up being affected.

Eve: [00:10:18] Okay. And then, like, what does your team look like? Who are you working with? Yeah.

Atif: [00:10:24] Yeah. So, for Amanat Properties, it’s a one man show. So basically, I JV with a company called Hanini Companies, Hanini Group sorry, and that’s in, based in Newark, New Jersey. And the construction is sometimes from them and sometimes from a third party. Architecture is from a third party. The development soup to nuts is my responsibility, including the expediting, because I tried an expediter and that’s not a good idea. So, I did not decide to go down that path. And then asset management, all that stuff is me. So that’s essentially the way that I’ve broken down Amanat Properties. I’ve had probably at least a dozen interns over the course of the years that I’ve done development, but it’s more because it’s fun and I like teaching as opposed to like actually having any benefit from it for me.

Eve: [00:11:12] So Covid must have slowed you down a bit.

Atif: [00:11:16] Covid messed a lot of stuff up. And I think in particular it was the idea of the left hand not knowing what the right hand was doing when it came to government decisions as to what work was considered essential versus not. And it was as crazy as the state of New Jersey declaring certain trades as essential, and the city of Hoboken declaring others as non-essential. And then even when they were declared essential, oh, City Hall was closed for a few weeks. So, we were never getting the inspections that we needed anyway. So, I think that that was the biggest frustration. The banks, I thought my banks, they were patient. My investors were incredibly patient. It was the municipal approvals and all of that stuff. That was the problem.

Eve: [00:12:02] And coming out of Covid, like we’ve heard a lot about the disarray of the commercial real estate industry and how is that impacting you? Do you have a next project lined up? Is it harder than it was? Even harder than it was?

Atif: [00:12:17] Yeah, I would say the biggest issue that I am foreseeing is this reality. So, I’m talking to a chief credit officer of a local community type bank in New Jersey and said, oh, so how are you doing with new commercial real estate loans? And he’s like new commercial real estate loans? What are you talking about? And I was like, no, like, seriously, aren’t you deploying capital? He’s like, only for Perm and only to people that we’ve done business with before that have a significant amount of cash at our bank. That’s it. And that type of a of a response. I heard maybe a slightly more liberal like version of that from a super regional bank that I do a lot of business with. And then from the Wall Street and the larger banks of the community development banks that are operating in this space. For them, it’s generally business as usual, but the issue often is that the checks under $10 million, like there’s no use of, like they can’t do them anyway. Before they wouldn’t do them and now, they wouldn’t do them. So, I think it’s the evaporation of options, which is the issue right now. And I think coming forward for the next two years, it’s not going to get any better.

Eve: [00:13:30] Not going to get better.

Atif: [00:13:31] Yeah, there’s about $1 trillion of commercial real estate debt coming due dominantly in office and retail and dominantly held by regional and community banks. So that the lender that would lend to people like us, no, they’re not, they have bigger issues now.

Eve: [00:13:49] Right, it’s pretty difficult times. That’s really depressing Atif, but it’s really true and I think the bank collapse earlier this year is also going to make lending even harder because now experience will count even more. So, it makes it very difficult to start a career in real estate, you know.

Atif: [00:14:08] I feel like experience is often the catch-all term to incorporate many shades and variations of biases together, because the quintessential problem many of our colleagues, when we were together at the Small Scale Developer Forum that Jim Heid runs in Philadelphia, the last one, is that is the chicken and the egg problem. How is it possible to have a diverse group of developers in this country when your requirement is to have done 50 projects already? So, unless you were born to come out of the womb with 50 projects done, how would one even do that?

Eve: [00:14:42] Yes, it’s a very big problem. Very big problem. Let’s move on to the second company, which is now called Commonplace, which I think probably, I’m guessing, addresses some of these issues. So, what does Commonplace do? What is Commonplace?

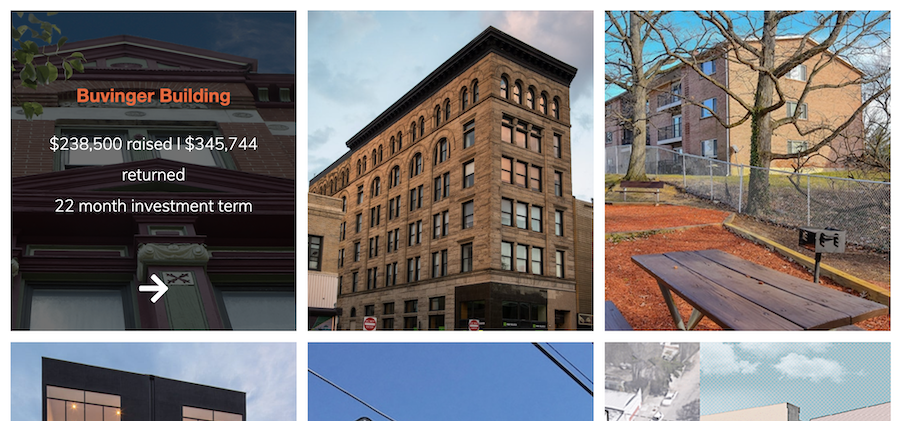

Atif: [00:14:56] Sure. So, Commonplace is not a real estate development company or an investment company like Amanat Properties. It’s a technology company and it’s one that’s considered a startup. So, we have venture capital financing. And what our mission is, is to help impact developers be able to access capital more easily in order to do the good work that they’re doing. So, we’re a team of six, based in New York, and our focus is on making double opt-in qualified introductions between impact developers as well as capital providers. That’s our first product. And from there we’re building out a suite of other activities and initiatives and products that we hope to release in the next couple of months.

Eve: [00:15:45] Interesting. How far along are you with the product? How many introductions have you made?

Atif: [00:15:50] So we’re about 150 a week is where we’re at right now. So, we’re starting to now do the, like the assessments from the past quarter of how many went to first conversations, how many went to second conversations, and how many went to term sheets. And I think over the next quarter, we’ll be able to reassess that as well. But essentially what we’re, we’re approaching the problem from the perspective that the issue isn’t necessarily technology, and the technology is the accelerant of something like this. But the issue often is simply the relationship not existing. So, from that perspective, we’re taking actually, frankly, a low tech approach to the introductions and then implementing technology in different layers to make that accelerated. And we’re actually seeing this as the test case for us to be able to deploy something that is more robust and more technology native, which we’re calling Capital Applications. And that’s a product that we’re excited to launch with six capital providers in the next couple of months.

Eve: [00:16:53] Oh, interesting. So, when did you start Commonplace?

Atif: [00:16:57] So commonplace. We started in its original iteration in 2020 as REDIST, which was a software as a service company focused on data related economic development incentives and then Commonplace, we relaunched as Commonplace in May of this year.

Eve: [00:17:15] What prompted you to reimagine it?

Atif: [00:17:18] So I mean, I thought when I was banging my head against the wall and capitalizing my deals that, gosh, it must be economic development incentives that’s going to solve, they’re going to solve all my problems. And I was like, these are really hard to figure out and find and learn and get. So why don’t I put all the information together and I’ll make my life a lot easier and probably that of developers. So, we did that. We gathered all the data related to 6000 different incentives in 13 states. We curated all the content and wrote that up in a way for developers to understand, and we piloted that with 250 companies. We had paying customers. And often what we heard from our customers and from the folks that piloted our product was this is great, could you help us find debt for a new construction multifamily project in Detroit? Because we don’t know any community banks in Detroit that want to fund new construction right now. Or, like another classic one that we heard was, oh, I have all the capital from my 80 different sources for a repositioning of a historic hotel in a majority minority neighborhood in Chicago, but we just need another million and a half of equity and we don’t have any more friends and family to go to for $10,000 checks. Could you help us find some more equity? My favorite one was a developer in New Jersey who had said, oh yeah, we’d love to get debt help. We need help with debt besides the incentives. And he’s like, you’re a licensed architect, would you, could you also design our whole development for us too?

Eve: [00:18:54] So are you adding in design services?

Atif: [00:18:57] Oh, no, I’m not going back to that one. And also, it’s been so long since I’ve gotten CAD, but generally the three people that I’m describing all were of a similar style person, which was a midsize impact developer that was developing in a majority minority area. And we realized like the similarities again and again, and that’s what made us take a pause, spend a couple months, do a bunch of research interviews, go through our notes again and figure out how we want to address the same problem in a different way.

Eve: [00:19:27] Really interesting. Well, that brings me to the final one of the three I know about, and that’s called, the podcast, American Building Podcast, which you host. Tell us about that and what motivated you to launch it.

Atif: [00:19:41] Sure. This was motivated by the magic of LinkedIn. So, the new CEO of Michael Graves Architecture and Design, His name is Joe Furey. He has the three letters after his name it’ not AIA, it’s CPA. And he is probably the most fascinating head of a design firm that I’ve seen because he’s no nonsense. It’s like, let’s get to the point. And I think particularly for firms that are going through transitions where their founders have passed, particularly when it’s a very iconic founder, it is, not in every case, but I think it’s a challenge I’ve seen in several different places to transfer the business development responsibilities to the new generation. So, long story short, Joe was following a bunch of my LinkedIn posts that I did when I left Extell because, I mean, given I wasn’t developing because I couldn’t find the equity and the debt fast enough.

Eve: [00:20:35] The capital, yeah.

Atif: [00:20:36] So I had to fill the rest of my time doing something. So, I was making LinkedIn posts and Joe saw this and he was like, hey, you seem like a really interesting guy. Would you want to come and just grab coffee? I said, funny enough, I’m actually at my parents’ place, which is like five miles away from your office. Let’s meet tomorrow morning for coffee. So I met him and then I invited him to a panel that I was hosting at the Harvard Real Estate Symposium on Entrepreneurship and Intrapreneurship within our industry and we just started, on the way up, we were just like talking a lot about how does he, as a firm, reach out to a new generation of potential customers, who are now in their 30s and 40s leading development firms all across the country? And we said, you know, both of us listen to podcasts. Let’s just do it, let’s figure it out. So, we basically came up with our plan, what we wanted to do. We dug into our virtual Rolodexes of friends in the city, and the thesis that we wanted to bring was, let’s talk to a new generation of developers and the ones that you don’t see on the cover of the Real Deal, the ones that you don’t see on every single industry panel, though, and you know exactly what I’m talking about, all of those people. So that’s what we started with. And I think we really kind of struck a chord with people. We got some really great guests on. So, Vishaan Chakrabarti from Practice for PAU, great, great architecture design studio. Marion Gilmartin, Melissa Birch. A whole set of people that are really amazing. So our 75th episode we recorded yesterday with Keith Rand from Mill Creek Residential. So yeah, that’s basically the path.

Eve: [00:22:23] And what have they told you? What have you discovered in these interviews?

Atif: [00:22:27] So in each of these interviews we wanted to get to the heart of it is, the why of what they actually were solving for it. What was it that drove them to develop this building or design this building? And what is it that a listener can take away from them to understand what is the future of our industry going to look like? Generally speaking, that was season one and two and then three focused much more tightly on housing in the greater New York City area. And we included, started including a journalistic style monologue in the beginning that talked about a certain issue in great depth. So one of the ones that I thought was really fascinating was where did the modern system of home mortgages come from? Like, how did that even start? So, we kind of go all the way back to FDR, the 1940s, and describe that process on the way back. So that’s what made this season a little bit more unique than the other ones.

Eve: [00:23:26] Interesting. But what have you learned about developers, this next generation?

Atif: [00:23:30] Do you know? What I would say is this, as that as easy as it is to stereotype our whole industry as being in it for the money, which is usually what people yell at me when, I’m a city planning commissioner in Hoboken as well, so that’s usually what people in the audience will yell. They just yell indiscriminately aloud from the audience. And a couple times I’ve also done like the so tell who are these developers you’re talking about? But I think what, so what I’ve learned is that there are many people that aren’t that and there’s many people that care about the place that they develop. And there’s many people that care about the people that are going to live in, work in or enjoy the buildings that they’re creating. And that’s something that is deeply inspiring because I think the other description or stereotype of our industry tends to dominate the public psyche.

Eve: [00:24:22] I think that’s true. And then what about architects, this next generation of architects? How is the industry changing? Is it changing? Because, you know, architects are very undervalued on the whole. And I’m, I’ve puzzled for years over why that isn’t more actively addressed because I think they bring enormous value. But I’m not the norm in that thinking, right?

Atif: [00:24:51] Yeah, I think that it probably comes to something that my therapist would say, which is about boundaries. And I think that architects are terrible at creating boundaries in terms of what they will do versus what they won’t do and how they value themselves versus what they will give away for free with the hope of being able to get something else. And I think perhaps an old school way of thinking about this is what H.H. Richardson said, which is that he’ll design anything from a cathedral to a chicken coop. And I think the new-age version of this is where an architect’s values overlay with what they will actually do. So, for example, Vishaan Chakrabarti, the architect that I mentioned, makes it explicit in the manifesto for his business, he will not work for authoritarian regimes. He will not design a prison. So, and he is not interested in doing stuff related to law enforcement. So, I think that all of those areas and declarations are the beginnings of this boundaries of saying that this is me, this is what I do, I am valuable. And if you choose to value me, this is the price associated with it. And if not, somebody else will. That’s the tough one.

Eve: [00:26:08] I really admire that. But I’m thinking of value in a much broader sense. Like, I walk around my neighborhood or where I have my little cottage and I’m just appalled when I see the buildings that are going up in a place that has such distinct character. And the buildings are thrown up by builders who have never been trained to recognize that character or replicate it or build anything that fits into it. And architects are not even a thought. They’re just not a part of the conversation. And so, we end up with really wonderful places being just ruined over time by either an unwillingness to think about what it means to put up a building and the space it creates. And I am, I’m appalled when I talk to people about this who don’t know what architects do saying, but they’re so expensive why would I why would I need one? The builder can do that for me. I’m just puzzled at why the architecture industry hasn’t been able to find a way to talk about its value broadly.

Atif: [00:27:20] Yeah, I think that there is this element of, um…

Eve: [00:27:25] Elitism.

Atif: [00:27:26] Elitism. I think this idea that you poor people don’t deserve nice things and architects don’t work for poor people. And I think the, what I think about is also the minimization of our trade by the increasing presence of legality and fear of lawsuits throughout every aspect of our industry. So, I think the AIA has done a wonderful thing by codifying contracts that our industry uses as our norm for both owners, architects and contractors.

Eve: [00:27:57] And builders.

Atif: [00:27:58] And builders. Yeah. And I’ve read those contracts as a principle. Like I’ve needed to read all of those contracts when I’m hiring a contractor, I’m like, gosh, architects, we’ve really backed ourselves into a corner. And when I think about, let’s go all the way back to one of the greatest, still one of the greatest buildings of all time is the Taj Mahal. So, the head architect, his name is, was, Sir Ustad Ahmad Lahori. So funny side story, he’s essentially a Pakistani that designed in India, which is a whole other side story. But the amazing thing is that, um, as an architect, it wasn’t like he just drew the drawings and was like, okay, you do it and if you have a problem, I’ll probably sue you. Or if you want to sue me, let’s go to court. His whole responsibility was everything, including the supply chain. And what I found so amazing is he was responsible for the team of people that were getting all the precious stones and all the precious materials like Jade from China, Tourmaline from the Middle East, all of these different things. And they all spoke all these different languages. And he was responsible for all of that. And I think that owning of the whole process is what allows architects to truly be maximized in their value in the way that you’re describing.

Eve: [00:29:11] Yes, but I still puzzle over how that’s ever going to be brought into, you know, everyday lives because streets, neighborhoods, blocks are ruined by poor design, and then we all get to enjoy that.

Atif: [00:29:28] I mean, there’s some avenues. Let’s think, so, I mean, it’s not like us having to turn the clock all the way back to the, I guess that would be the 1400s when the Taj was built. Maybe I’m off by a century two, something like that. But I mean the idea is citizen commission. So, I think participatory democracy in some ways is a very good thing. And I think having planning commissions and zoning commissions and historic commissions can have positive benefit there. I think perhaps another one that’s not a fully baked idea, but the idea of perhaps making real estate more accessible from an investment perspective, I think there’s a really beautiful thought process around that. And then I would say…

Eve: [00:30:07] You mean like we’re doing at Small Change?

Atif: [00:30:09] Exactly! Yes.

Eve: [00:30:11] Oh, yeah. That’s how you build wealth, right?

Atif: [00:30:14] Completely, and I think that there should be, the way that the SEC thinks about and regulates funds at a larger level, I think being able to think through and structure and support the great work that Small Change is doing and people that are looking to invest at the smaller scale sounds like that’s something that’s worth effort from a legislation perspective and maybe even a funding perspective rather than huge amounts of money thrown at infrastructure to the tune of billions of dollars through the last two major bills and the Biden administration.

Eve: [00:30:44] So what was your favorite interview ever, and why?

Atif: [00:30:50] Okay, so my favorite one ever, and I love all my babies, all my babies are wonderful, all my episodes. But my one that I think of in particular is the episode I did with Louis Schump, who’s a creative director at Gensler, on the subject of the West Side Pavilion, which is Google’s new headquarters in Los Angeles. And it’s essentially, it’s a conversion of the mall that was featured in Clueless, the movie, into a mixed-use office complex. And as part of that, we talked a lot about the goals of Google and the, I guess you could say, the largesse of a large company like that to be able to promote good urbanism at a large scale. And then one area that we explored is just reeling it back. How did America get so many malls to begin with? So, both of us are amateur historians.

Eve: [00:31:45] And what are we going to do with them now? Right?

Atif: [00:31:49] I have an aunt, a great aunt, who is from Toronto that I’ll see in a couple of weeks. And every time I see her, she has the most creative ideas of what to do with, she’s not even in real estate industry, but she’s the most creative ideas and the one that she said nearly like a decade ago, far before the pandemic, she was like, hey Atif, basically what I do every day is I drive to the mall and all the other Indian aunties, we just walk around the mall together. And then sometimes we have to go to other places to pick up our grandkids and we go to other places to drop them off and then we come back. Wouldn’t it be great if there was like the mall just became my house and then the day care was there too, and then my son and daughter just lived nearby. Like, wouldn’t it be cool? And I’m like, oh my God, you hit on it right there, that’s it. That is what, that’s what malls should be. Multi-generational housing.

Eve: [00:32:37] If you want to live in that environment, that is. Because I’m not sure I could do it. Okay. So, one final question. Unless you have another company you want to explain to me?

Atif: [00:32:52] Any other companies, I would say no, I’m good for now. We’ll stay a three.

Eve: [00:32:56] You’re good for now, okay. So, one more question and that’s what’s next for you?

Atif: [00:33:02] Good question. So, we’re, for Commonplace, we’re coming up to a fundraising milestone. So, we’re excited about that. And we hope that that will allow us to expand our product offerings, our vision, our scale and bring on some more great talent to help us do that. And I think that there’s a couple other ideas I have in the works in my head. One of them is the investment portfolio that I have and scaling that perhaps to a much larger scale, allowing folks to be able to invest in workforce and affordable housing more easily on an individual level. That’s probably something a bit separate. And then the one that I love, which I feel like this is this could be the final one that I ever do, I call it, lovingly, it’s the wedding planner for high end home renovations. So, I literally, every month or so at least some family members, some neighbor, some friend from college is like, oh, P.S. I just bought a $5 million brownstone in Brooklyn. Can you just do, like the whole renovation? Because I know you did such a good job on it with your parents’ house. And I’m like, there has to be a business here. And that would be so much fun to do.

Eve: [00:34:17] So, you’re not even sure what’s next for you?

Atif: [00:34:22] One of all of them is the potential next one, so we’ll figure it out.

Eve: [00:34:26] Well, it’s been a pleasure talking to you. You’re such a high energy person. I can’t wait to see what you do next.

Atif: [00:34:31] Thank you so much for the opportunity, Eve. I love your podcast. I love everything that you’re doing and I’m so looking forward to seeing you again at our next Small Scale Developer Forum in just a couple of months.

Eve: [00:34:43] Can’t wait, in the beautiful Savannah, right? Okay.

Eve: [00:34:53] I hope you enjoyed today’s guest and our deep dive. You can find out more about this episode or others you might have missed on the show notes page at RethinkRealEstateforGood.co. There’s lots to listen to there. Please support this podcast and all the great work my guests do by sharing it with others, posting about it on social media, or leaving a rating and a review. To catch all the latest from me, you can follow me on LinkedIn. Even better, if you’re ready to dabble in some impact investing, head on over to smallchange.co where I spend most of my time. A special thanks to David Allardice for his excellent editing of this podcast and original music. And a big thanks to you for spending your time with me today. We’ll talk again soon. But for now, this is Eve Picker signing off to go make some change.

Image courtesy of Atif Qadir