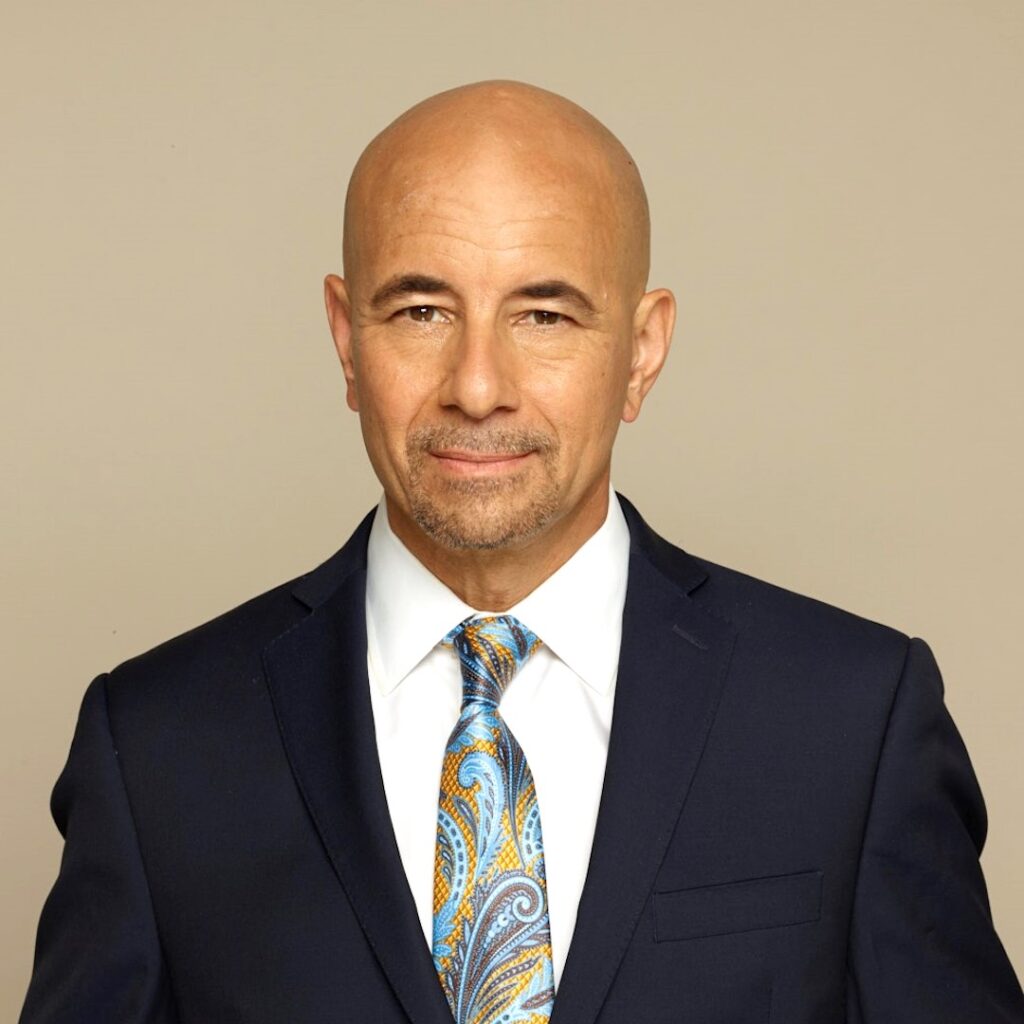

Former U.S. Congressman Ben McAdams is the founder and CEO of the Common Ground Institute, an organization supporting jurisdictions working to create revenue and other public benefits from government-owned real estate through public-private partnerships. He is also a Senior Fellow for the Government Finance Officers Association, where he leads the Putting Public Assets to Work Incubator, working with jurisdictions across the U.S. to support their development of public asset management strategies.

From 2009 through 2020, McAdams served as a Member of the United States Congress, a Utah State Senator, and Mayor of Salt Lake County, where he represented 1.1 million constituents and balanced a budget of $1.2 billion. In his public service, McAdams brought Republicans and Democrats together to find solutions to address homelessness, improve education and health outcomes, and promote evidence-based decision-making at all levels of government using innovations, including the first social impact bonds to achieve measurable outcomes for the public good.

Prior to elected office, McAdams taught Securities Regulation at the University of Utah Law School and was an attorney with Davis Polk in New York and Dorsey & Whitney in Salt Lake City, where he specialized in public and private securities transactions for U.S. and international issuers.

Read the podcast transcript here

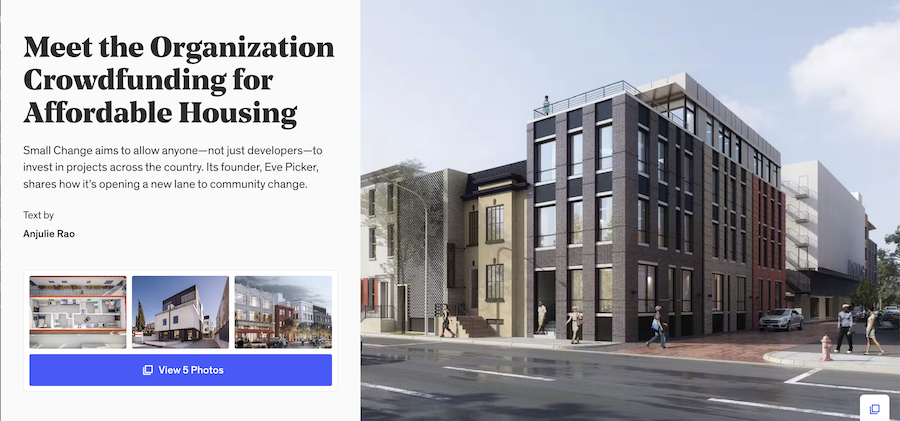

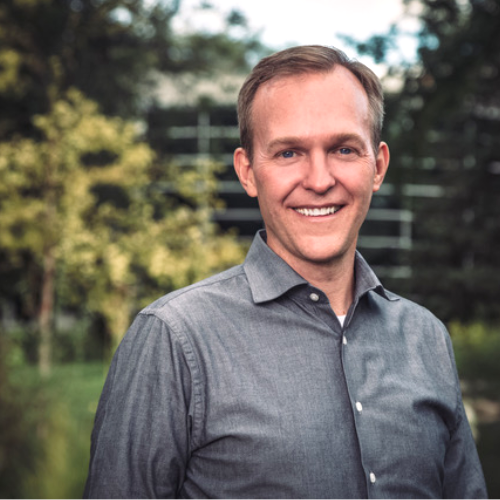

Eve Picker: [00:00:13] Hi there. Thanks for joining me on Rethink Real Estate. For Good. I’m Eve Picker and I’m on a mission to make real estate work for everyone. I love real estate. Real estate makes places good or bad, rich, or poor, beautiful, or not. In this show, I’m interviewing the disruptors, those creative thinkers and doers that are shrugging off the status quo in order to build better for everyone.

Eve: [00:00:48] As mayor of Salt Lake County a decade ago, Ben McAdams was frustrated that there wasn’t $500,000 in a $1.3 billion annual budget for a promising early childhood education program. Not one to permit defeat, he decided to map the value of the city’s underutilized real estate, and that yielded an impressive number. All of a sudden, the city had $45 billion on its balance sheet. I found out there is actually money under our mattress Ben says. It’s real estate that is just forgotten. Since then, Ben has spent time in politics as mayor, senator, and congressman, but now he’s launched an incubator to help cities map their public assets, much like he did a decade ago, providing a path to solve issues that need money like affordable housing and homelessness. Every city should listen in.

Eve: [00:02:11] Hi, Ben. Thank you very much for joining me today.

Ben McAdams: [00:02:14] Eve, it’s so great to be with you.

Eve: [00:02:15] So the common theme in your life for many years was politics. You’ve been a mayor, a senator, and a congressman, but you started off as a securities attorney. How does a securities attorney become a politician?

Ben: [00:02:29] Well I am passionate about public service and really, from early days in college, wanted to be in a position that I could give back to a community that I love. And so, I went to law school and also found a passion for corporate finance. So, I went to a firm in New York. I did a lot of work in Latin America with issuers who were raising money in the US to do big projects, typically in Latin America. And I found kind of an alignment between my passion for public service and finance. And what I saw was the power of finance to transform communities for the better. So, I did a lot of work in Brazil and with telecom and what we saw, I’d spent some time in Brazil previously, and when I was there nobody had a telephone. And we saw because the cost to install a landline to a home was about $5,000, and nobody could afford that upfront cost to install a landline. And then cell phones come along, and people are raising money to just skip the landline process and go straight to cell phone.

Ben: [00:03:32] And I saw in Brazil, everybody went from not having a phone to having a telephone and what that meant for their productivity, for their ability to earn money, to stay in touch with family and loved ones was transformative. And so, we found an alignment between the power of finance to do good and to lift people for the better. And so, I spent about five years working in, as a securities lawyer, I taught securities law at the University of Utah. And then there came a chance to transition to directly public service. So, I went to work for the mayor of Salt Lake City as his director of government affairs. And in that capacity, I found that somebody with a good finance background was able to add a lot of value to government. We were able to, you know, figure out how to do the Rubik’s Cube of some pretty complicated public projects that we were trying to get done. And I think that was then my life mission. I found this passion for bringing a knowledge and understanding of private finance to the world of social impact.

Eve: [00:04:34] So, after quite a few years in politics, you have now launched something called the Putting Public Assets to Work incubator. So first I want to ask what are public assets?

Ben: [00:04:47] So public assets can be any number of things. You know, it can be a mass transit system that we’ve built. It can be an educated population. It can be, you know, public safety infrastructure. But when I was mayor and looking to, so I served first for the city of Salt Lake City, and then I was elected to the Utah State Senate, and then I was elected Salt Lake County mayor and I served for six years as mayor. And that was my favorite job, because I was really in a position to impact my community for the better. And one of the things that I found is that we knew, we know empirically from numerous studies that have been done globally, that it’s less expensive to educate your population than it is to incarcerate. It’s less expensive to treat somebody with addiction than it is to watch them cycle through a homeless services system. It’s less expensive to, you know, to maintain a road than to let that road fail and then come in and rebuild the road. But what frustrated me is, while we knew these things would save taxpayer dollars over the medium term, we just didn’t have the money to do it. And I said, there’s got to be a better way. We know we are acting in a way that’s going to cost us more money in the long run. We’ve got to figure this out. So, I started looking at our budget. And, you know, government budgeting is really built around cash flow. We project how much money we’re going to bring in from taxes and fees, and then we decide where we’re going to spend that. And what we ignore in government budgeting is our balance sheet.

Ben: [00:06:13] What assets does government have? How much are those assets costing us to maintain and what opportunities can we derive from those assets? So, I started focusing on the balance sheet aspect. You know, if we have, if we’re able to better utilize our mass transit system, that means and to better utilize that asset means we’re building fewer roads, maybe fewer stormwater systems and water and electrical systems. We can actually save money by better utilizing existing assets. Pretty quickly we came to what I think is the biggest asset class of government. It’s real estate. And, surprisingly, government has very little understanding of what real estate they own, what it’s worth and because of that, they don’t make good strategic decisions about how to manage their asset, how to minimize costs and maximize value. So, I said, you know, as a county, we are spending over $1 billion a year. We should have a handle on what we own and what it’s worth and start thinking about that as a way to minimize expense and maximize value. So, we did an inventory. We hired Urban3, who came in and did an inventory for Salt Lake County, helped us to identify all of our assets and hone in on the value. And what we found was shocking. So, we said we’re going to exclude assets that have no commercial value. We excluded our watershed, our, you know, our ski terrain is sacred here, so we don’t want to touch the ski terrain. Of course, our airport runway you’re not going to, that’s going to just be what it is. It’s an asset of a different…

Eve: [00:07:44] So you’re talking about the land, even the land. You just didn’t include those assets that you’re not going to touch.

Ben: [00:07:48] We didn’t include those. So, we looked at land that had commercial potential in addition to or instead of government value, so we could make better strategic decisions. What we found was in a county that’s about 500mi², we found 44mi² of commercially viable government owned land that was not on the tax rolls. We estimated the value of that was about $13 billion. This was 2017. So, you know, it’s about 10% of our land mass. It’s about ten times our annual budget that’s tied up in non-producing land. You know, some of these things we’re still going to want them to be non-producing. A library serves a function. But we started thinking, you know, could that library in an urban area, it’s a one story building with a big parking lot, instead of just being a rundown, dilapidated library surrounded by ten story office and residential, could we think of a library as a ground floor retail, so to speak, of an office building and reduce the cost of owning and operating that facility and actually maybe even generate some revenue off of it if we were able to activate the land.

Eve: [00:08:54] Let’s just go back a bit. So, these public assets that you found, like the library, is a fascinating example. What are some other examples? Not just vacant land, like not just abandoned houses, right? It’s way more than that, right?

Ben: [00:09:07] Yeah, vacant abandoned homes is a big one, but that comes with some other policy challenges around it. You know, governments think in terms of decades and centuries, and private sector thinks in more in terms of, you know, 7 to 10 years. So, we found a lot of parcels that 50 years ago, 75 years ago, we made a decision. Maybe we were widening a road and so we did some eminent domain to condemn some homes to acquire parcels. And we will widen that road, but we didn’t need the entire parcel. So, you have kind of the scrap that’s off to the side.

Eve: [00:09:38] Right.

Ben: [00:09:38] I can think of, you know, here in Salt Lake we have a major roadway, you know. So that roadway is a valuable asset. Transportation assets are expensive and desirable. And on the side of that roadway, there are these fantastic parcels of land that have signs on it that say property of the government, you know, and we go out and we cut the grass, and we clean up graffiti. And they just have been sitting there for decades being maintained and not being activated. So, there are not vacant abandoned homes but vacant parcels that the government is banking for another use or just kind of maintaining but has forgotten.

Eve: [00:10:14] Oh, interesting.

Ben: [00:10:15] So that’s one asset class.

Eve: [00:10:17] I just have to hop in. I bought one of those little abandoned pieces of property in Australia. I’m doing a project there with my sister, and there was this tiny little laneway that we really needed to make the project. It’s a very dense urban site. The city didn’t even know they owned it. They, we paid them for it in the end, quite handsomely. But they didn’t know they owned it. No one had a record of it anywhere. It was a very interesting exercise in a very desirable neighborhood.

Ben: [00:10:47] Surprisingly, or maybe not. But that scenario where government does not even know that they own a valuable parcel of land, we’ve seen it over and over again in this work. So, you know, helping them understand what they have and then make strategic decisions about that is a big part of putting assets to work. To your point, it’s not just the vacant parcel of land. Maybe it’s the parcel of land that is being used. It’s the library, it’s the senior center. It’s the parking lot adjacent to a rec center that you know could be used. You still need parking, but in some of these urban areas, does it really make sense for government to have a surface parking lot? The private sector’s concluded that it doesn’t. Right?

Eve: [00:11:24] The highest and best use, yeah. Yeah. We’re working with a developer who actually made a deal with Alexandria to purchase and redevelop three surface parking lots, and he’s building 50 housing units and putting robotic parking in place and expanding the parking, I think by three times, all on those three lots. So, I think that’s a really good example of what you’re talking about, right?

Ben: [00:11:50] They’re getting everything they wanted, right? They’ll still have parking there, but they’re just bringing property on the tax rolls and giving people a place to live.

Eve: [00:11:57] Exactly.

Ben: [00:11:57] That’s close to transportation and transit.

Eve: [00:11:59] Right? Right.

Ben: [00:12:00] It’s checking so many boxes instead of just one.

Eve: [00:12:03] When you uncover the value of a city’s assets, how can you leverage them? On a developer’s balance sheet obviously, their net worth is what banks look at and they want to make sure that they have enough money to support a project. If it fails, how does it work in government?

Ben: [00:12:19] Evidenced by the fact that we had $13 billion of latent real estate it doesn’t work, right? So, you know, every government has a story of where they’ve taken a public asset and done a public private partnership and activated that asset. So, there are exceptions to that. But these exceptions are few and far between. It’s, you know, one every several years. And when I saw that we had $13 billion of opportunities, it dwarfed the, you know, the one opportunity that we could think of three years ago where we did something. And look, we did do, we are doing interesting things and governments are doing these, but how do you systematize it and scale it that it’s not just something that happens when somebody knocks on your door, and then they’re persistent enough to wait out a government process that takes three years. These are the examples that are successful. How do we make this the norm of what we do not an exception? I’ll tell you, when I taught securities law, I would start my class with a kind of a dumb joke. I would say two economists are walking down the road and one economist says to the other “hey look, I think I see a $10 bill lying on the ground up ahead”. And the other economist says “you’re an idiot. There’s not $10 lying on the ground up ahead. If there was $10, somebody would already picked it up”.

Ben: [00:13:31] And so I think about this with the public assets, you know. I see $13 billion under the mattress of government. Is it a mirage? Is it really there? And what are we missing? Why is it there? And I think there has to be an explanation for why the market is failing in this. And I think the first explanation is government doesn’t even know it’s there. And when they do discover it, then the second explanation is the process to unlock that is so cumbersome. So, I’ll give you an example, a different government outside of my own that we were working with in this Putting Assets to Work. They have a salt pile, you know, governments when it snows, they need to de-ice their roads. And 75 years ago, they put this salt pile in an industrial corridor on an industrial rail line. Smart place to put it on a kind of a low value parcel of land. And then they go into autopilot. The salt pile has been there for 75 years. They use it. They know, you know, somebody knows that it’s there. We are looking at this and we say, do you realize your salt pile, that industrial rail line is not an industrial rail line today? Like many governments are doing with rails to trails. It’s a trail. It’s some of the highest value real estate in your city. And your salt is sitting on land that’s worth $10 million.

Ben: [00:14:44] If you would just pick up your salt and move it a couple of miles away, you’ve got $10 million in an area that has incredible affordable housing needs. So, government can decide, do you want to pocket $10 million by selling the land? Do you want to roll up your sleeves and become part of a public private partnership and create some affordable housing? All of those are options. And so that government is doing exactly that. But I think if so many other governments where once they’ve identified that opportunity, the next step would be to turn to the public works director and say, okay, can you do a public private partnership to create some affordable housing? And the public works director would say, are you kidding? Like, I’m overworked, underpaid, and I don’t know the first thing about doing a multifamily affordable housing development. And you want me to do that on top of my job? And so that starts the process of five years of it’s on a back burner but the public works director is trying to write an RFP. They have to maybe carve out money out of their budget to hire a consultant to help them write the RFP. And it just, the systems of government…

Eve: [00:15:48] Oh, I know I’ve been there. Most of my projects have been very small public private partnerships. So, I totally understand the pace of things in government.

Ben: [00:15:57] Yeah. And so most private developers, in your perspective, just say it’s not worth the effort. There’s a, it’s a great parcel but down the road there’s a parcel I can just buy in a few months and be done with it and be on my way with my project. I can’t spend three, five years trying to unlock this. And so, where the market’s failing, why there’s still that $10 bill on the ground is first, government doesn’t know that it’s there. Private market and the neighbors know that it’s there but the process for talking to government, to engage with them and to form a partnership with them is just so exhausting that nobody’s doing it. And so that’s a couple of things.

Eve: [00:16:31] It’s exhausting. And then I wonder what this partnership looks like. Because I’ll give you an example of a project I did that, hearing what you’re saying, I think the government would have, if they had approached it differently, they would have something of much greater value now in their pocket. I redeveloped a building that’s 30,000ft² and had been vacant for 15 years in a largely Black demographic. I responded to an RFP just like the one you talked about. Spent a lot of time putting my response together. Was apparently the only developer who responded. And eventually the city sold me the property for $1,000, and it was really a liability for $1,000. They also helped in a number of ways with loans and deferred interest payments and matching facade grants, the sort of things they normally have in their pocket. But now we’re like 20 years later and the building is fully occupied, bar Covid, which rocked the boat a little bit and worth a lot of money. And I often wonder if they had said, look, we’ll give you the land and we’ll give you these special grants, but we want to be a partner what they would have today.

Ben: [00:17:40] That’s right.

Eve: [00:17:40] You know, they would have a part of a project or building they basically gave away because that neighborhood has, a little unfortunately, gentrified. Just a few blocks away we have the Google headquarters and Facebook, and it’s very close to the universities. It’s very desirable. Right across the road there’s very expensive apartments that have been built. And I mean, no one could have foreseen that, but no one really. They didn’t have the belief in the property that I had, you know. So how do you change, how do you flip that switch?

Ben: [00:18:14] Well, we have some tools that we have developed that we are advising governments to try to unlock this, because if the tool is look to your public works director, look to your library director to figure this out that doesn’t work. But I think you’re right that also just selling it for, you know, long term lease for a dollar a year, selling it for $1,000, government’s leaving money on the table and the private market’s probably fine with that. But if you want government to not just do this once every five years, but maybe make it a part of what they’re doing every day and to accelerate the pace of these partnerships, there has to be a different approach. But government has some things going for it that the private market doesn’t have. First of all, we own these land, these parcels outright. We have been sitting on them for decades and there’s no expectation to generate revenue tomorrow. The private market has to look at a IRR. How much are you going to make per time, right? And government, I think government should look to say can we, are we using tax dollars or taxpayer assets well? But we can say we can go to a partnership and say we want you to pay a market value for this, but we don’t need that market value up front before you do the development.

Eve: [00:19:27] Yeah, it’s a patient wait.

Ben: [00:19:30] We can contribute it to…

Eve: [00:19:31] Patient capital.

Ben: [00:19:32] Patient capital. Yeah, we’ll contribute it. We understand that you’re going to have bank debt that’s going to be very sensitive to time. You may have other equity investors that are very time sensitive. So, we’re going to negotiate some benchmarks. And once the project has stabilized and you’re paying your debt and you’re paying your investors and negotiated rate that, you know, then we’ll be in the waterfall, but we can be towards the back of the waterfall. And so, government can say we’re willing to absorb that time risk that, you know, we’d like to get paid, but if it takes five years or seven years, we’re willing to be patient. It’s better than what we’re doing right now, which is spending money to let it sit, you know.

Eve: [00:20:10] Right.

[00:20:10] And so there’s some tools that government can bring to the table. So, to capture value but also…

Eve: [00:20:15] Sometimes in those instances I’m thinking about this building. The fact that I renovated the building, redeveloped it, meant that other developers came in because I just happened to like being in underserved neighborhoods. I like the challenge of those projects, and it’s where I prefer to work. I want to do something that’s meaningful. But other developers are waiting to see where something’s already been invested. And so, you know, maybe government’s thinking, well, we’ll give this one away, but we’re going to get other ones. As a result.

Ben: [00:20:45] They have the ability to do, to lead out, to maybe do some philanthropic investments with their land, because, you know, their baseline is zero. So, absolutely.

Eve: [00:20:56] Okay. So interesting. So how does the incubator work? The Putting Public Assets to Work incubator?

Ben: [00:21:04] Yeah. I was mayor. I was then elected to the United States Congress. I served only two years in Congress. I lost my re-election in 2020. So, I still had a passion for public service, a passion for finance, and came back to this idea that I’d been working on as mayor of public assets. And I just said, I know there are billions of dollars under the mattress of government. I know that if we can unlock it, the amount of good we can do in our communities, you know, that can, to your point, it can catalyze growth in an underserved neighborhood. It can form affordable housing. But maybe what you’re doing is just looking to maximize revenue into government to then support childcare or, you know, childcare vouchers or investing in homeless services or investing in clean and renewable energy. There are so many different things you can do with that asset once you unlock it. So, I said, this is where I want to spend my time, is figuring out how to help governments unlock the value of their underutilized assets. So, I teamed up with the Government Finance Officers Association, GFOA. They’re a membership association, you know, pretty much every city, county, school district, the CFO of those government entities is a member of GFOA. And so, we worked with GFOA. And I said, look, putting assets to work should be part of every government’s finance. Let’s start working with GFOA member governments and helping them and others but helping them to unlock the value of their real estate. So, we started Putting Assets to Work incubator.

Ben: [00:22:34] We’ve now worked with about 15 governments, mostly cities and counties across the country. All of them saw what I saw when I was mayor. They’re all sitting on billions of dollars under the mattress, and they have challenges to activate that. So, we help, we go in, we help them identify their assets. We help them see what it’s worth. You may have an asset that is in the far flung reaches of the county that you would say, put on a back burner for now, but we help them identify 10 to 15 assets that they should take action on immediately that are really that proverbial, the salt pile. So, and then we work with them to develop some policy tools to help scale it, to make it not a one every once every five years initiative, but to make it part of what they’re doing. So, the concept that we have there is we go in, and we serve as a, what we call a municipal property advisor. And we say, you know, once we’ve identified the asset, we would like to represent you in structuring a transaction. And we’re going to do this at no charge or very little charge to the government. You know, the private developers will pay a finder’s fee for this. So, our model is built on passing that fee onto the private developers. But if we can say, look, we can clear all of this government red tape, all of these hurdles to give you a parcel that is in a prime location in a great downtown area that has already…

Eve: [00:23:55] Hell yeah, I’m in!

Ben: [00:23:56] …cleared the boxes. Yeah. And then, you know, and here’s our fee, you know. But we pass that not onto government, but onto the private sector. So, all of a sudden, the library director, the public works director, we say we don’t need you to model a multifamily real estate development. Just tell us what you need. You need us to find another parcel for your salt? You need a library that’s 20,000ft², and you need so many parking stalls. Okay, we’ll take your inputs, and we’ll work up a model, and we’ll bring it back to you, government to sign off on. And if you sign off, we’ve got private developers who will, you know, also come in and pay for the architectural work and the design work to get these projects shovel ready. All of this government doesn’t need to pay for that. They just need to create a process where they can get out of their own way and still maintain what they want out of the land. And then and then let the private sector do what they’re going to do.

Eve: [00:24:48] So you said you’ve worked with 15 cities. Can you mention some of them?

Ben: [00:24:53] Yeah. I think some of the ones that have taken this work and are now doing amazing things. City of Atlanta. The mayor of Atlanta, mayor Dickens, said he wanted to build 20,000 affordable housing units. That’s a huge goal. But they identified all of these public assets that can come in and be part of the capital stack to start lowering the cost of development and consequently insisting that those developments have affordable housing. We worked the city of Cleveland. They’re trying to create jobs. And so, they know that they have, they’re actually losing population. So affordable housing is not at the top of their to do list. It’s clearing space. You know, they want to bring in employers and they said we need parcels that are 30 acres or larger. And they did the survey of the entire city of Cleveland and said that parcels that could work for that they had one in the city of Cleveland. So, they said, we’ve got to do some work to assemble parcels, remediate any environmental contamination, and make these available. So, Atlanta and Cleveland are two that we’ve worked with. Of course, you know, given my roots, we’ve worked with Salt Lake City and Salt Lake County. We are doing some work with the city of Annapolis, Maryland. Chattanooga, Tennessee.

Eve: [00:26:02] So pretty big cities.

Ben: [00:26:04] Yeah. Austin, Texas. And some small ones, too. And some small ones, you know, Sugarland, Texas is another one that’s doing some really innovative things.

Eve: [00:26:11] I don’t suppose my city, Pittsburgh is on the list, right?

Ben: [00:26:15] Not yet. We’d love to talk to them. Although they have done some interesting things thinking about their assets as well, you know.

Eve: [00:26:22] Our Urban Redevelopment Authority has always been at the forefront, I think. Yeah, they’ve worked a lot at clearing some very large vacant assets called steel mills. You know, they’re very good at that. And they were a fabulous partner in all my projects. So, yeah. So, do you have a waiting list? Do you have cohorts that you take through? I mean, how does it work?

Ben: [00:26:44] We do. So, we have cohorts. We are preparing to start with our third cohort. So, you know, we think the, the best size for a cohort is about 4 to 5 jurisdictions, and it takes us roughly 6 to 8 months really depending on the speed of government.

Eve: [00:27:00] Doesn’t work fast.

Ben: [00:27:02] Employees have a busy schedule. Yeah. So, and we understand that we work with their time. So, we do most of the workload ourselves. But we’ve got to get into their data and sort through their data. And we need some collaboration with them, or we need them to look over our work before we go public with it. We want them to give a trained eye to tell us what they like. So, it takes about 6 to 8 months to do a cohort. We’re launching a cohort over the next couple of months. We have, almost full, we actually have one spot left for a government to join with this cohort. You know, we do 4 to 5. So, we’ve got four, but we’re looking for that fifth one. And then we’re also soliciting interest for our fall cohort with putting assets to work.

Eve: [00:27:41] It’s fascinating.

Ben: [00:27:42] So yeah, if any governments are interested, we’d love to talk to them.

Eve: [00:27:45] You must get pushback, right? There must be plenty of places that say, why on earth would we do this? We’re stuck in our ways. We don’t want to change.

Ben: [00:27:55] Yeah. No, a little bit. I think you get some pushback from some of the staff that say, you know, if I’m that public works director and I say my budget’s $100 million a year, I don’t want to spend my time on, you know, this salt pile just. It’s fine. It works for me right now. What’s the reward for thinking innovatively? And so oftentimes, what we look for when we’re deciding who to admit into the cohort, we want to see a mayor, a council, some city managers who are willing to push it a little bit to say, no, this is important. We want to be better stewards of taxpayer assets. And so, we want to see some leadership from the jurisdiction. Sometimes we think it’s our job to have some uncomfortable conversations. One jurisdiction we worked with, we saw that they had an abundance of parks and open space that were poorly maintained. And they probably had like, I’m a as a mayor, I’m a big supporter of parks and trails and open space. But if they’re too many and underutilized by the public, we said, maybe, you know, you should think about, you know, a slight reduction in your parks and go for quality over quantity. And, you know, that’s always a hard conversation to have. And we think it’s our job to like to provoke that. So, we encourage them to look at their parks parcels. And do you really need a pocket park across the street from a pocket park or can we rethink how you’re using those assets? So, you know, there are some uncomfortable conversations that we think it’s our job to have.

Eve: [00:29:25] So, what’s been the biggest surprise for you in this work?

Ben: [00:29:28] Well, I think my biggest surprise was to find that what I discovered in Salt Lake County was not unique. It is every, 100% of the governments we’ve worked with. And many governments say, look, we don’t have any vacant assets. We’re on top of it, and we’ll go in, and we’ll find them everywhere. It’s, you know this this concept actually isn’t new. It’s done pretty regularly in Europe and Asia when they think about, you know, the city of Hong Kong built their entire mass transit system without tax dollars by simply saying, we know that when we put in a transit stop, the land around the transit stop is going.

Eve: [00:30:05] Increase in value.

Ben: [00:30:06] Increase exponentially in value. So, they just were thoughtful about how they built a transit system and paid for their transit system with the value that the transit system created. So, it happens in Europe and Asia. I think it just doesn’t happen in the US because our governments are so much more fractured. You have cities and counties and school districts and housing authorities and transit authorities. And, you know, we have a mosquito abatement district here that, you know, and to get all of these entities working together is hard. And so, I think we have to develop new tools that they don’t need in, you know, in a jurisdiction where there’s just the federal government and it’s very hierarchical and aligned. So, you know, it’s been a surprise that how many assets we have and how, and what incredible opportunities there are to unlock it.

Eve: [00:30:55] One other big question, how do you plan to scale this work? What are your plans?

Ben: [00:31:01] Yeah. Well, first of all, I would say we hope people copy us. My hope is that ten years from now, this is the norm of municipal government. Everybody has a municipal property advisor or 2 or 3 who are on tap with the government, who are making unsolicited proposals to government to say, hey, we’ve noticed you have this parcel, and we’d like to help you think about how to use it better. And that government is well versed in saying, okay, let’s have that conversation, you know, and here’s what we want. And if you can hit these objectives, then we’re game. So, I would love people to copy what we’re doing and to make this the norm of municipal government. Because if we do, so many communities are going to be benefited. We have the capital to solve our homelessness crisis, to solve our housing affordability crisis, to transition to clean and renewable energy. We have the assets to do that. It’s just a matter of figuring out how to activate those assets.

Eve: [00:31:53] It’s really fascinating. Ben, thank you so much for joining me. I can’t wait to see where this goes, and I hope my city is listening.

Ben: [00:32:03] We’d love to talk to them.

Eve: [00:32:04] Okay. Thank you so much.

Ben: [00:32:07] Thank you. Eve.

Eve: [00:32:20] I hope you enjoyed today’s guest and our deep dive. You can find out more about this episode or others you might have missed on the show notes page at RethinkRealEstateforGood.co. There’s lots to listen to there. Please support this podcast and all the great work my guests do by sharing it with others, posting about it on social media, or leaving a rating and a review. To catch all the latest from me, you can follow me on LinkedIn. Even better, if you’re ready to dabble in some impact investing, head on over to smallchange.co where I spend most of my time. A special thanks to David Allardice for his excellent editing of this podcast and original music. And a big thanks to you for spending your time with me today. We’ll talk again soon. But for now, this is Eve Picker signing off to go make some change.

Image courtesy of Ben McAdams