Impact investing has grown globally in both depth and sophistication and is now valued at $USD715 billion according to a 2020 study by Global Impact Investing Network (GIIN). But there are still many challenges. Here in the US, most of those funds are invested into cities and gentrifying areas, and although many low-income communities are beginning to see more capital investment, the most marginalized are still left out. For poor Black, native and other marginalized groups, opportunities to build wealth have historically been systematically denied. Redlining, made illegal in the 1970s, still occurs today and we know that all lending is not equal. Now the coronavirus pandemic is exacerbating the problem.

In recent news Netflix announced that a 2 percent share of its cash will go to financial institutions that serve Black communities and PayPal has also announced a $500 million fund to support black- and other minority-led start-ups. This is a promising start but to really effect change requires an understanding of the systems we operate in. They may have been built for everyone, but they don’t work for everyone.

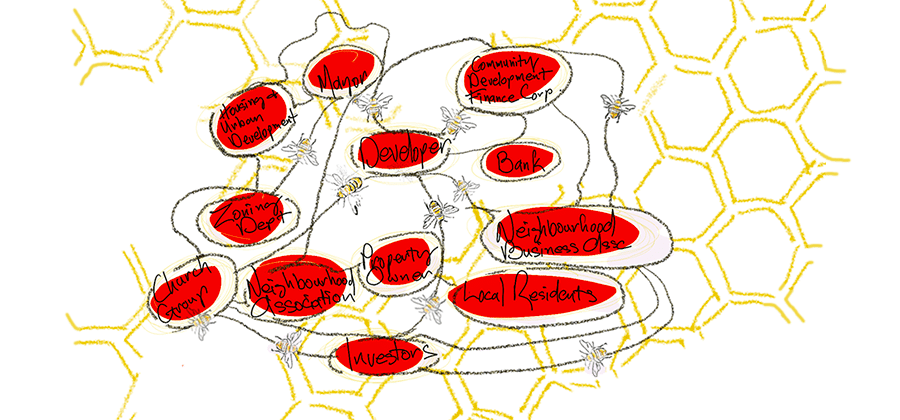

Cynthia Muller, a thought leader of the impact investing ecosystem and director of Mission Driven Investment at the W.K. Kellogg Foundation, believes that power mapping is an important tool to help gain an understanding of how to structure a project that will be meaningful and beneficial to a community. The parties brought to the table for any particular project might include residents, real estate developers, planning departments, investment banks, venture capital, community development corporations and others. With a power map as a visual aid you can begin to recognize the roles and relationships of all parties and identify the decision makers with power who might be influenced to make change. Here are the steps required to make a power map:

- Identify the people involved, the problems and the decision makers.

- Place the person or institution that can make the decision or enact changes to fix the identified problems at the centre of the map.

- Think about any associations or relationships. This requires thinking about any connection including family, neighborhood, religious, political or financial that might influence the central decision maker. Place these in a ring around the centre.

- Look carefully at the mapped network to determine any connections, including secondary connections like family members. These are the relational power lines.

- Identify the people with the most relational power lines as well as those with less and mark them differently. If there are no connections, plan to learn more about that person.

- Make a plan of action. Using the relational power lines and work out the best way to access people or institutions.

Power mapping is a great community engagement tool which helps to conceptualize networks and spheres of influence. Listen to my interview with Cynthia Muller to learn more.

Original artwork by David J Allardice