Loan secured. Construction loan term sheet secure in preparation for construction start

Shovel ready. Entitled and ready to build

Quick Build. Anticipated 12 to 18 months construction period

Pre-sales. Planned to begin immediately after construction commencement

Walkable + bikeable. 5-minute walk to the Atlanta Belt-line, shopping, dining and at least 3 parks

Easy access. 15-minutes to Atlanta International Airport, considered the world’s busiest airport

Maximizing light. Fully open roof terraces

Non-standard amenities. Swim spa option, wet bar, home theater + panoramic views

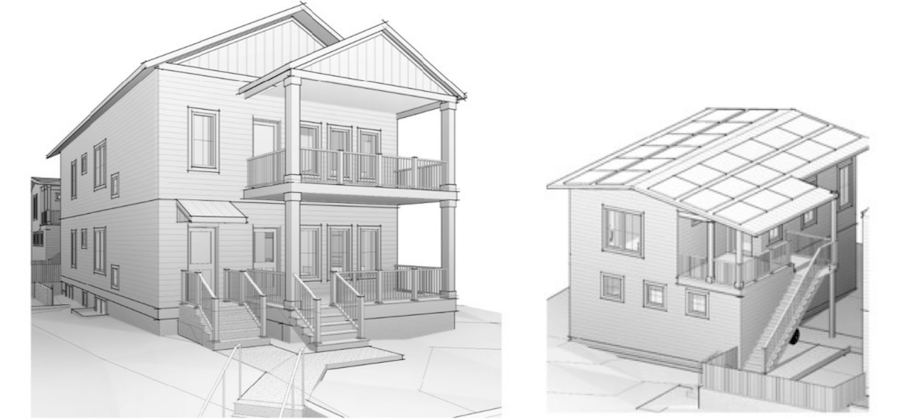

Distinctive, modern residences. In Atlanta’s Beltline District at the intersection of Memorial Drive SE and Stovall Street SE in Reynoldstown.

The developer is planning to build up to 14 luxury townhomes, ground up, designed to blend urban living with a “staycation” lifestyle. Each townhome is planned with features such as open roof terraces with 360-degree skyline views, floor-to-ceiling windows and spa amenities.

The site is adjacent to The Heritage On Memorial and completes a block adjacent to Madison Yards. It’s just 15 minutes from the world’s busiest airport and within 2 miles of downtown Atlanta, offering convenience and connectivity.There’s a strong diversity component with minority vendor participation. And they’re looking for investors, small and big alike, just like you, on Small Change.

This is not a solicitation of an offer to buy or sell any securities. All investing is risky and involves the risk of total loss as well as liquidity risk. Past returns do not guarantee future returns. If you are interested in investing, please visit Small Change to obtain the relevant offering documents.

Image courtesy of Swank Atlanta