Lorenzo Perez is co-founder and directing principal of Venue Projects, an inspired redevelopment practice based in Phoenix, Arizona. Advocates for LOCAL community, culture and commerce, Venue crafts one-of-a-kind environments and experiences throughout the Metro Phoenix market.

A native Phoenician, Lorenzo holds a bachelor’s degree in architecture from Arizona State University, an active Arizona real estate license, and has been working in the Valley real estate development industry for over 25 years. A nostalgic storyteller who finds magic in the details, Lorenzo likes to say he talks fast, plenty and daydreams often.

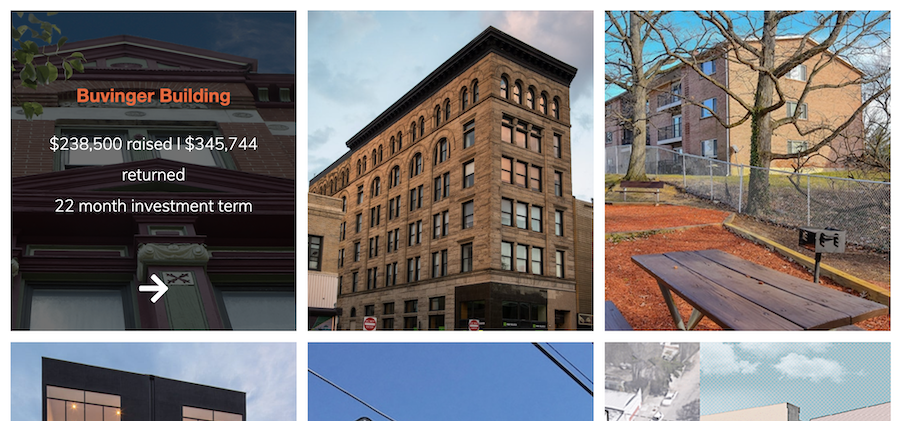

A long-time member of the Urban Land Institute, a sincere believer in design and context sensitive development, Lorenzo is often invited to share his passionate perspective on Venue’s artistic approach to developing human centric places. Notable redevelopment projects include The Newton (formerly The Beefeater); The Orchard, The Windsor, The Alhambra (Mesa, AZ) and Arrive Hotel.

Read the podcast transcript here

Eve Picker: [00:00:05] Hi there. Thanks for joining me on Rethink Real Estate. For Good. I’m Eve Picker and I’m on a mission to make real estate work for everyone. I love real estate. Real estate makes places good or bad, rich or poor, beautiful or not. In this show, I’m interviewing the disruptors, those creative thinkers and doers that are shrugging off the status quo in order to build better for everyone.

Eve: [00:00:38] It’s been four years since I first interviewed Lorenzo Perez, and I love his work every bit as much as I did then. Lorenzo advocates for local community, culture and commerce in his real estate projects and for crafting artistic, one-of-a-kind environments and experiences. He and his company, Venue, put that passion to work throughout the metro Phoenix area. This approach helped them to weather the last four years, pandemic, and all. Lorenzo was about to open his first hotel project right after everyone was sent home. And yet, well, I’m not going to say more because that would make me a spoiler. You’ll have to listen in.

Eve: [00:01:27] Hello, Lorenzo. It’s totally wonderful to have you back on my show.

Lorenzo Perez: [00:01:32] Hi, Eve. Good to have you here. Thanks for giving me the opportunity to be back.

Eve: [00:01:37] Oh, yes. So, on your website: ‘Create, Inspire, Serve’. That’s what you and your company, Venue Projects aspire to do. And I just want you to tell me about that.

Lorenzo: [00:01:49] Sure. When we first started our company, my business partner said opportunities were going to be abundant but staying on track with our ‘why’ is super critical if we’re going to be successful. He had had other businesses that he had owned long term, and so we sort of settled, why are we doing this? And for us, we distilled it down to ‘Create, Inspire, Serve’. And both of us were just itching to do creative work and to do innovative work and to experiment with new ideas. The idea of creating beauty, creating value, creating goodwill, new models, new product, new services was just exhilarating. So that was our first item is we want to create. We’re both just natural creators. Inspire. We had done the corporate thing. Big company, grew it, you know, and it was just the higher up we got and the more we got into that world, the more soulless it was and the less inspired, you know, it became about managing departments and divisions and it was just transactional. So, I just wanted to, I’m like, man, if we’re going to work and life’s not promised, I want to spend my days doing stuff that fire me up. I wanted to be fired up with the work I was doing. I wanted to be inspired. I wanted to do work that raised my vibration, but also gave me the opportunity to raise other people’s vibration and do work that inspired others to do fun, creative work that made a difference. So meaningful work.

Lorenzo: [00:03:27] And so that sort of led to the third item is serve. You know, the motivation was to I my career was doing really exclusive, high end, unconventional projects in my former life. Like, real high-end homes for billionaire clients in California and Arizona and it was interesting for a while. But, you know, no one got to see the stuff we got to do. We were always tied to non-disclosures. We couldn’t take photos. Privacy was super big, and I just wanted to do something that was meaningful. I wanted to take what we learned, use our talent, and use our creativity to do stuff for everyday people. And so there was this service thing. I wanted to serve my community. I wanted to serve myself, my family, our team, our investors. I just was like, we wanted to do it not just for us, but for some, make, I guess, a greater impact beyond ourselves. So that’s where we settled on create, inspire, serve. And we use it as a metric in, underwrite all our projects, both quantitatively, so we do proformas and we look at that, but we also do it qualitatively and we try to balance, you know, okay this makes sense but then the qualitative piece is, you know, are we achieving our ‘Create, Inspire, Serve’ with this. You know and we number it 1 to 3 and we rank it. And sometimes we have competing projects that we’re excited about all of them. And we want to do all of them. But we can’t. Right? We only have so much capacity. We’re only a nine-person firm. So, we break out the create, inspire, serve 1 to 3. We each grade it, my business partner and I, and we see which ones stand out. And sometimes it’s incremental.

Eve: [00:05:21] Do you keep yourself honest, yeah?

Lorenzo: [00:05:23] Yeah. And you know I’ve had lenders and even investors say wow, you actually do ‘create, inspire, serve’ in your underwriting. I said yeah, and I go we also do this thing we call holistic ROI, which is one of our guiding principles with our projects is we’re always seeking holistic ROI, which is emotional, social, cultural, environmental, and economic return on investment. And so, we do the same with that. If we’re if we’re not getting, you know, emotional return on investment, if we’re not excited about it, it goes out the door. Social, you know, is this something we can do for the community? Is it going to be fun? Fun is huge for us, right? And then the other stuff cultural are we you know, we preserving old buildings? Are we, you know, helping to create culture in our city and our state? And the environmental piece is huge. You know, we’re big adaptive re users both with buildings but also the materials. We like to reuse materials creatively. And then obviously we’re in this to be for profit. A lot of people say, well, are you a nonprofit?

Eve: [00:06:32] That came at the bottom of your list, Lorenzo.

Lorenzo: [00:06:35] You know, it did. It did intentionally. I read a great book written by Danny Meyer called Setting the Table. He’s a super famous restaurateur and entrepreneur and he said something about his restaurants, that he made his economic return, sort of the last. And I loved the philosophy behind it because he said, if you have good people, you treat good people. You put out good experiences, good work, you know, it’s not verbatim, but that’s essentially his message. The money’s going to take care of itself. And that’s been our experience. If we do what we say we’re going to do, if we put out great projects and create places that human beings feel nurtured and excited to be in, then they’re going to want to rent from you. They’re going to want to visit, they’re going to want to patronize our businesses, and they’re going to be strong. Which is a great segue to Covid because, you know, want to talk about an opportunity to test that thesis. Covid was really eye-opening and validating for us in many ways.

Eve: [00:07:39] Right. Interesting. Yeah, you should tell us more about that. But I was going to ask you first. I was going to just say your work is really stunning, and I hope that everyone goes to your website, but you pick pretty abandoned and ugly buildings.

Lorenzo: [00:07:53] We do.

Eve: [00:07:55] That no one else seems to see value in and then transform them into these really stunning places.

Lorenzo: [00:08:03] Well thank you. Yeah, that’s intentionally intentional. We started our company in 2008 going right face-first into the deep recession in Phoenix, Arizona, of all places. We were like ground zero for the major implosion in real estate. And for many years we were on the blacklist, right? A lot of people couldn’t invest capital here and all kinds of stuff. So, the opportunity was great to buy distressed assets and to experiment. And Phoenix, you know, definitely has its share of architectural gems. We’re a young city in American standards. You know, we didn’t become a state till early 1900s, 1912.

Eve: [00:08:47] Very hot city.

Lorenzo: [00:08:49] And a very hot city, especially right now.

Eve: [00:08:51] Yeah. it’s bad.

Lorenzo: [00:08:51] You know, our building stock isn’t like the East Coast or the Midwest, you know. God, I’m always so jealous of the building stock from the 1800s and early 1900s. Our stuff is early 1900s. You know, occasionally we have some late 1800s that were old territorial buildings. But most of our stuff in Phoenix is mid-century. You know, we’re a 1950s, post-World War II city. And so that, in itself, is unique in America. And so we just decided, you know, let’s show value in what we got. We got to work with what we got. You know, we don’t have those other gems that the other coasts have. And let’s see what we can do with what we got.

Eve: [00:09:33] That’s liberating because you…

Lorenzo: [00:09:35] It was very liberating.

Eve: [00:09:36] You’re starting with something so awful that you can just go wild, right?

Lorenzo: [00:09:40] Totally. Yeah. And, you know, we have a lot of masonry boxes here and wood frame boxes and, you know, boxes are the easiest thing to manipulate. And so, you know, I studied architecture too and went to architecture school. So, it’s, I’ve designed my company around being basically an active architectural studio where we figure out, okay, we have a building, it’s our project. And then it’s like, what do we do with this? People always say, well, what kind of developer are you? And I’m like, you know, we’re just entrepreneurial and opportunistic and we’re not pigeonholed into any sector. We’re not a retail. We’re not a hospitality. We’re not multifamily or office. We look at projects, we evaluate the neighborhood and the context, and then we try to bring something that adds value to that neighborhood. And it’s a very liberating designer approach to development. And it’s just kind of what we’ve done. And it’s been fun. It’s our philosophy is create, don’t compete, right? And a close second is, deliver the unexpected, right? So, let’s take something that has been an eyesore or a problem in a community, and let’s turn this thing inside out and let it become an asset. Let’s transform it into something that adds value, but also becomes a catalyst for reinvestment and redevelopment. And that’s been our model since 2008, and it continues to be a driving force in our company.

Eve: [00:11:02] So talk us through some of your favorite projects and why they’re your favorite.

Lorenzo: [00:11:06] Oh man, they are all…

Eve: [00:11:09] They’re all your babies, right?

Lorenzo: [00:11:11] They are. You know, God I look back on them and you mentioned our website. We’re going to go through an overhaul because we’ve got probably 3 or 4 projects that aren’t even on our website that are really strong candidates for my favorite. But, you know, it’s like you build on each one. Our very first one. I loved them all for very different reasons. Our first one is like our first-born child, you know, it just was so exciting, so challenging, so rewarding. It’s been the best returning in the history of all the projects we’ve done. But man, let me think about that. I just love them all for different reasons. What I loved about all of them is that they educated us and opened our eyes and tested us, and I think every other project that followed, we were able to apply those lessons learned, and I think it continues to do so.

Eve: [00:12:04] Tell me about the one you know that I was worried about all through Covid because you opened a hotel. Actually, you were still finishing it when Covid hit.

Lorenzo: [00:12:12] Yeah, yeah.

[00:12:13] That was your first hotel project, right?

Lorenzo: [00:12:16] First hotel project. I had worked on hotels in my former life as purely a general contractor, where we did an adaptive, pretty deep adaptive renovation of a mid-century hotel here in Scottsdale called Hotel Valley Ho. So very kind of similar, but this was my first one where we were principals, and we were the developer. We were leading the charge.

Eve: [00:12:41] You had a lot to lose.

Lorenzo: [00:12:42] Yeah, we had a lot to lose. And we were co-developing this with a joint venture partner, much bigger developer, much stronger balance sheet, thank God. We had their savvy and talk about, you know, those project opportunities really throw you in the test. And you test people’s values and how they lead through problems. And we have great partners. I mean, we knew we were with true battle-hardened veterans. They just didn’t even bat an eye, you know, and they were a calming force. And we’re like, hey, we’ll get through this. Been through all kinds of stuff. We got to just figure it out. So, um, yeah, the hotel, my gosh, we started it in 2018, in a very hot hospitality market here in Phoenix. Man, bookings ramping up for all kinds of events. And I remember being excited and literally in early February of 2020 going, oh my God, we’ve never timed a project so well in a market cycle. Not… Lesson learned. Don’t ever get ahead of yourself.

Eve: [00:13:53] Four weeks later, right?

Lorenzo: [00:13:55] Literally, literally four weeks later, the world completely changed. I mean, we were on track to open April of 2020 to a really strong, you know, we had our, we were bringing on people. We were starting to work through our punch list and, but our hotel operator is out of LA and Palm Springs. At the time that co-developed the hotel with us, they had East Coast hotels, and they also were monitoring hospitality, and they started raising the flag. Hey, there’s some serious stuff going on in Asia and Europe right now that, you know, if it does get to the States, it’s going to be real interesting. And that sort of was presented to us towards the end of February and man, talk about. But you know, by May, was it March 16th I think, remember?

Eve: [00:14:53] Oh, March 15th, I came down with Covid.

Lorenzo: [00:14:56] Yeah, March 15th. I mean, I want to say it was the weekend before that they called us and said, we’re shutting down all our East Coast hotels. It’s going to happen in California. It’s going to happen. This is going to happen. And we were like, wow, really? We think we were kind of in shock and kind of like, what do we do? We have a hotel that’s about to be finished and opened. And we had people being trained. We were hiring. We’re making contractual agreements, big time financial decisions. And it was stressful. It was stressful, you know, and I think that month, March, and April were pretty crazy. We had to figure out, how are we going to finish this? Are we going to be shut down? You know, we’re almost to the finish line. God, where we could see the light at the end of the tunnel. After a really long, complicated, intense buildout. We were all exhausted and here we were going into, we thought we were going to get into revenue and change the the energy from pouring money out of our pockets into pouring money into our pockets. And it was a scary time. It was it was crazy. But I would say that project, we called it Arrive Hotel at the time we’ve since rebranded, which is another part of the Covid story we can talk about. But yeah, what a what a deal. We actually had to sit on an empty hotel, fully finished for an entire summer.

Lorenzo: [00:16:25] And you know, we’re burning overhead dollars like you couldn’t imagine. Utilities, we had to have everything, air conditioning through the summer. We had to have people living on property. So, it wasn’t vandalized because, you know, we fenced it. We had security, we just were, you know, the streets were empty here, too. Everything was on shut down lockdown and only essential workers, and Arizona was one of the states that allowed construction projects to continue. But we also dealt with a lot of the early breakouts. I got Covid in June of 20. I was a asymptomatic carrier. I had no idea I had it but brought it home to my wife and she was on total lockdown as the only way she got it. And it was just crazy. You know, we had the entire crew, crews, we had to do the whole early quarantining where we had to shut the entire job site down, so it was just, it was chaotic at best. But on top of that, you know we have a lot of restaurant-anchored retail properties that were operating assets. And so simultaneously I’m dealing with the hotel, but I’m having to speak with five different lenders because all our government shut down restaurants. So, I’m sitting there going, oh my God, you know, if they can’t open, they can’t pay rent.

Eve: [00:17:41] That must have felt really surreal.

Lorenzo: [00:17:43] It was crazy. It was really surreal. And I remember having, talk about sleepless nights, sitting there, really having to kind of just breathe, stop, and breathe and just go, okay, this is so out of your control, so don’t make yourself sick over it, right? Like it’s important you stay healthy right now and not stress out so that you’re, you know, I’m thinking about what’s in the air, you know, is this something that’s going to kill me? Is the whole company going to implode? I mean, it’s the world falling apart. What’s going on here? Is this going to financially just be a disaster?

Eve: [00:18:15] I was negotiating rent abatements with all my tenants while I had Covid, with a fever of over 100. I don’t even know what I said to them.

Lorenzo: [00:18:27] Oh, God. What an experience, right? I mean, I just sat there some days and laughed and said, what? This is one heck of an adventure. I mean, who could have ever saw this coming. It was an interesting experience. I mean, I’ll tell you what.

Eve: [00:18:44] I don’t want to have it again. Put it that way.

Lorenzo: [00:18:46] Me either. But I’ll tell you, it was the most diverse mix of emotions, from extreme fear, nervousness to, elated gratitude for just the, the little things, you know. Banks working with you, reassuring you that, hey, we’re in it together. You’re good. You know, we have a great relationship. We value relationship. Do what you got to do, you know, just keep us posted. And I was just like, God, I’m so grateful for the choices and the decisions we made with our partners, with our lenders, with our tenants. Top to bottom, grateful for the neighborhood relationships we had, our staff, our team. Grateful for the US government throwing us PPP and an EIDL loan so could keep our team employed and keep us functioning. I mean, in many cases, it was extremely just so devastatingly sad and scary. But in many cases, it was just a wonderful experience in terms of just seeing how people can put aside differences to come together and make things happen. So, I’m with you, I don’t ever want to go through that again. But I’m grateful that I did and I’m grateful that I survived it. You know, we knew people who didn’t survive illness. And a lot of companies didn’t survive financially. Some people were devastated by bankruptcies and foreclosures. And I’m just so grateful, you know, it was one heck of an experience.

Eve: [00:20:25] So what happened with the hotel? How what, like, where is it now?

Lorenzo: [00:20:29] Oh my God. So, the hotel is doing really well right now. Thank you. And and I’m so grateful. And surprisingly, we started pretty dang strong. That hotel project was going to be the death of me, though. My God, we hit every frickin’ curveball obstacle that you can imagine.

Eve: [00:20:50] I shouldn’t be laughing.

Lorenzo: [00:20:52] Oh my God, no, but it’s just, you know, I look back now and I’m just like, how the heck did we survive that? We were a year late. We were $4 million over budget. We went through a pandemic. We had a really tough experience with a general contractor. We went through five superintendents. We were in the early stages of serious market escalation. Phoenix is a hot market still. I mean, it was hot through the pandemic. It was hot before the pandemic. We have so much going on here in construction, semiconductor industry, a lot of infrastructure, work, office, industrial, logistics, just name it. And so the demands on our workforce and resource spaces, concrete, stuff like that, I mean, we just, we hit it all. We also went through two of the wettest El Nino years during construction. And of course, it’s when we were doing site excavation and grading and underground utilities and foundation work. So, we literally had to shut our site down like 4 to 6 weeks sometimes because we were so saturated. And, you know, this desert soil doesn’t absorb like, it’s just so hard. So, we get runoff and it just takes forever for sites to dry out. And then the dry heat comes. It didn’t help that we were actually kind of humid during that time. So, it was very just uncharacteristic experience for Phoenix.

Lorenzo: [00:22:25] And then we get open, finally get open in the late summer, just out of necessity. I think we opened half the property in August of 2020 and to our surprise, booked, like crazy because people wanted, we had a lot of people coming from California escaping the lockdowns there. We were pretty open in Arizona, so people were literally coming for getaways to Phoenix, and they were staying at our hotel. A lot of people were kind of living there, renewing, coming back every other weekend. We had a lot of staycationers, people that were locked up in small apartments or whatever, they wanted to be… If you haven’t seen our hotel and it’s not on our website yet, but you can look it up. It’s been rebranded as Rise Uptown, in Phoenix, Arizona, and it’s a boutique hotel. We took two 1950s office buildings and created a boutique hotel out of it, and it’s very indoor/outdoor oriented. So, we actually had, I forget the hotel group, Conde Nast did a write up with Arrive Hotels, and we had some other group come out and interview us, but they actually walked through the property late 2020 and was like, oh my God, this is a poster child of a post-pandemic hotel because it was so indoor/outdoor oriented. It was basically like a 50s hotel, like you didn’t have to go in any corridors to get to your room. You could walk upstairs or take an elevator. You had choices. And out of 79 rooms, 59 of them have private, dedicated outdoor space.

Eve Picker: [00:24:07] Oh, perfect.

Lorenzo: [00:24:07] Very roomy balconies with views and private courtyards on the ground level rooms. And so, people could socially distance, easy at our hotel. So, I mean, our appraiser actually did a post certificate of occupancy walk with me. And he was very critical. He used to drive me nuts actually and this was very rewarding and validating because I got the last laugh. But he was very kind of critical about the hotel. He just couldn’t see the vision for it because it was just such an old beat-up building. And he saw the pre-construction estimate. He did a mid-construction estimate, and then he came and did the final appraisal. And when I walked up to him, he’s just snapping photos like crazy on his phone, and he’s just got the biggest grin on his face. And I walk up to him and I said, hey, how are you? And he goes, oh my God. He goes, I am just speechless. I cannot believe what you guys pulled off here. The transformation was just incredible to him. And he said the same thing. He goes, man, I thought you would be at a disadvantage having to get to your rooms in outdoor corridors and walk upstairs or take an elevator like you were so outdoor oriented, it just seemed like it was going to be a disadvantage to you. But he goes, I actually think this is going to be such a differentiating element to you, and it’s such a differentiator in the market, and it really proved that. It does to this day, we are a very hot location for not only out-of-town visitors, but a lot of inner-city interstate staycationers. We offer day passes at our pool, and that’s become just such a huge revenue driver for us, for people who want to come to a cool hotel and hang out. And so, it’s just, it was such a tough journey but man, I’m so grateful to say.

Eve: [00:26:00] That’s really good to get at the end of it.

Lorenzo: [00:26:02] Yeah, we’re doing really well.

Eve: [00:26:04] So I wonder if, you know, if you’ve been thinking about like, a world full of other viruses and climate change and how does that impact the way you think about design, or do your designs fit right in, you know/

Lorenzo: [00:26:19] So our properties, if you look across our portfolio and I’ve had lenders and appraisers say this, I’ve had brokers say this, they’re like, man, your properties were so resilient during Covid because we always approached our projects with a balance of indoor/outdoor. You know, people always characterize Phoenix as hot, but nine out of the 12 year, nine out of the 12 months here, I mean, we live indoor/outdoor all year long. It’s just really that. And even in the summer, I’d say we’re outdoors a lot because it’s a dry heat. And then when the sun’s down, or if you’re in shade and you get some air movement and a little bit of moisture or humidity, it’s actually somewhat tolerable. But I would say 8 to 9 months out of the year, people want to be outdoors. And the most successful retail and now residential now hospitality environments offer an indoor/outdoor experience. So, in Covid, our projects were really pretty resilient. Our retail restaurant, because we have expansive patios and outdoor space, so that really proved to be, I mean, some of our restaurant tenants had multiple locations, and the only ones they kept open were on our properties.

Eve: [00:27:37] That’s interesting.

Lorenzo: [00:27:38] Because they just were set up for takeout and outdoor lingering. And so that was just really validating for us. And our lenders actually were like, God, you know, they’re asking their other developers these questions, how are you designing to be more resilient in an environment where we may need to be more indoor/outdoor? And our buildings also open up, they breathe. So, we have a lot of multi-slide doors, flip up windows. They become basically pavilions in spring and fall. And so, a lot of the buildings were able to just open up and people felt safer in them. And so, our restaurants, all with the exception of one, are pre-pandemic. They’re killing it. They’re doing really well. They’re struggling because the lack of workforce in the back of house and kitchen. But we’re seeing that in any industry, we just we don’t have the workforce that we used to, but revenue wise they’re doing really well. We have one restaurant on a property that just hasn’t made it back. They’re more of a fine dining concept, and it just didn’t lend itself well to take out, and it didn’t lend itself well in a post-Covid world. It’s more expensive, it’s labour intensive, and they’ve decided that they are going to concentrate on a smaller restaurant and put all their energy. They’re going to close their second one in the spring.

Eve Picker: [00:29:08] Interesting.

Lorenzo: [00:29:08] We’re helping them with that transition. And, but we’ve got a lot of suitors for that space because they saw how resilient it was. And so, we’re grateful that we’ll hopefully be able to transition into a new operator here soon.

Eve: [00:29:23] So after all of this, what’s next for you?

Lorenzo: [00:29:27] We’re in transition. We’re in our 15th year of business. I’ve got a business partner who turned 75 earlier this year, and he’s starting to eye working less, grinding less and traveling with his wife and want to go spend some time with their grandkids up in Oregon. So, we are thinking about, you know, a strategic transition plan where they’re working themselves. Both of them, him and his wife fill very big roles here. He pretty much watches over our construction field guys and execution of projects because we’re a design build, develop, own, and operate practice. And his wife is my right-hand person. All things in the business, HR, risk management, finances, managing our accountants and entity management for our partnerships. So, we’re working through succession. We’re also trying to think about, we’ve sold off some stuff to just make us a little more liquid in that transition. And, but we acquired a bunch of properties during the days when we could find distressed assets here. And so, they’ve been sort of just income properties for us. But now we’re in entitlement on many of them. We’ve decided a few years ago to shy away.

Lorenzo: [00:30:41] Actually, we decided pre-pandemic to shy away from a lot of the restaurant anchored retail, just because there’s a lot of players in that space now. And we wanted to really get back into innovative housing and experiment there and different concepts we have in mind. So, we’re working on that. There’s a need for housing big time in Phoenix, a diversity of product. So, we’re shifting our attention into some really interesting housing projects, multifamily rentals, some infill pocket community stuff. And we’ve loved the hospitality. I mean, the hotel, as difficult as it was, it’s, you know, hospitality is weaving its way into every sector, you know, I mean, every sector. Medical, office, I’d even say industrial, like, you know, wherever humans are, there’s a hospitality bent. So, we love playing in that space. We’re still focusing on urban infill and adaptive reuse as a core business. However, most of our housing projects are going to be new construction because they’re on big lots with vacant, small vacant buildings that really didn’t lend themselves to be repurposed. And so, we’re getting into that space. We’re venturing into more joint ventures.

Eve: [00:31:58] This doesn’t sound like winding down, Lorenzo.

Lorenzo: [00:32:02] Well, it’s not winding down.

Eve: [00:32:04] It’s moving on to the next thing.

Lorenzo: [00:32:06] It’s moving on. Well, it is. This has been the delicate dance in our evolution as a company. We’ve got a really young team that’s just inspired and fired up to keep doing what we do. And so, in one hand, I’m looking forward to working with this just energetic bunch of just talent that we’ve been able to groom and cultivate over the years and find a stable financial future and fun future for them in their career development. On the other hand, I’m trying to manage this transition with my partners. So, they’re just very supportive. And I think they are thinking, yeah, we want to help you get to the future, but how do we do that? So, they have less risk, but they also get to play a role in continuing to co-invest alongside us and stuff. So, it’s been exciting.

Lorenzo: [00:32:56] The last few years, I’d say the last 3 to 5 years, we’ve done more joint venture work with other, bigger developers where they’ve had stronger balance sheets or more experience, but they’ve been attracted to working with us for our creativity. And, you know, we came from big, corporate, very disciplined companies so we’re sort of an outlier in the sense that we’re small, but we’re very disciplined and we’re extremely dreamy and creative, but we’re very, we’re counterbalanced in reality. And, you know, we’ve always had to bank and underwrite our projects, and none of us want to lose everything we worked so hard to create. So, we’re kind of this interesting piece that can plug into a bigger company, into a bigger development arm and play with a bigger canvas, I’ll say. So, I see more of that kind of work in the future. We’re working on a great project right now I told you about. It’s a public/private partnership with the city of Tempe. We were invited by the city to take a look at their five-acre site. It’s an old historic flour mill that sits right in the middle of Mill Avenue.

Eve: [00:34:06] Oh, fabulous.

Lorenzo: [00:34:07] It’s tied to the founding of the city. It’s on light rail. It’s serviced by, it’s in a walkable, dense urban area. But it’s an industrial eyesore, but it’s right in the middle of the best location. And so, we’re excited to do it. We’ve never done a public/private partnership, but we’ve partnered with probably one of the largest local developers, if not the largest local developers in Arizona. He’s very accomplished. He’s been a mentor of mine, and we never thought we’d find an opportunity to work together. But when he heard, he actually threw my name out there and said, these guys got to do this project, they’re perfect for it. When I turned him down and said, I would love it, I’m not even scared to tackle it, but I know nothing about public/private partnerships, or it has to be on a land lease structure. I don’t even know how you would capitalize it. It’s so unconventional and that’s what this guy excels at. He’s a land lease expert. He’s done tons of PPPs, he’s a finance genius. And he says, hey, why don’t we team up? Let me take that piece, and you do what you do. And together we actually might get this thing done. I think there’s been 7 or 8 attempts by other developers over decades to try and redo this site. It’s very nuanced, it’s t’s very complicated. It’s a culturally and historically significant site for Arizona tribal communities. It’s a tough site. It’s a hillside. Geotechnically it’s tough. It’s historically protected. It’s just got a lot going on and a lot of political and civic emotion behind it. So, it’s, we’re in the fishbowl. It’s going to be one heck of a challenge.

Eve: [00:35:46] When you get a little further on with that one, I’d love to talk to you about that again.

Lorenzo: [00:35:49] Absolutely.

Eve: [00:35:50] And I’m going to threaten what I’ve been threatening a lot of people. I just have to come and look at all your buildings.

Lorenzo: [00:35:56] Oh, you’ve got to come out.

Eve: [00:35:57] Not in the Summer. Not in the summer.

Lorenzo: [00:35:58] No, come in the spring or fall, and we’ll put you up in our hotel and we’ll have a fun time. We’ll take you out to some fun restaurants.

Eve: [00:36:05] I was planning to do that in 2020.

Lorenzo: [00:36:09] Well, you’re going to need to unplug in late 23 or early 24, so give me a ring.

Eve: [00:36:16] This is fabulous, Lorenzo. It’s really exciting to hear about your work and…

Lorenzo: [00:36:21] Thank you.

Eve: [00:36:21] … I’m just hoping it gets better for you. Better and better and better.

Lorenzo: [00:36:24] Thank you. So do we.

Eve: [00:36:26] Okay.

Eve: [00:36:41] I hope you enjoyed today’s guest and our deep dive. You can find out more about this episode or others you might have missed on the show notes page at RethinkRealEstateforGood.co. There’s lots to listen to there. Please support this podcast and all the great work my guests do by sharing it with others, posting about it on social media, or leaving a rating and a review. To catch all the latest from me, you can follow me on LinkedIn. Even better, if you’re ready to dabble in some impact investing, head on over to smallchange.co where I spend most of my time. A special thanks to David Allardice for his excellent editing of this podcast and original music. And a big thanks to you for spending your time with me today. We’ll talk again soon. But for now, this is Eve Picker signing off to go make some change.

Image courtesy of Lorenzo Perez