Maybe this is not super big news to you, but it is to me.

In plain English, there’s a recommendation on the table that if approved by the SEC, will permit small businesses to raise up to $350,000 without the burdensome financial review requirements that currently exist.

This promises to be a momentous change for the small-scale developers who come to my SmallChange.co platform seeking to raise a little capital from friends and family, neighbors and enthusiasts. It will simplify and speed up the process for them AND reduce their costs.

And all of this inches us towards a more level playing field, making it a little simpler for small, women and minority developers to get a foothold in the very un-level landscape of real estate development.

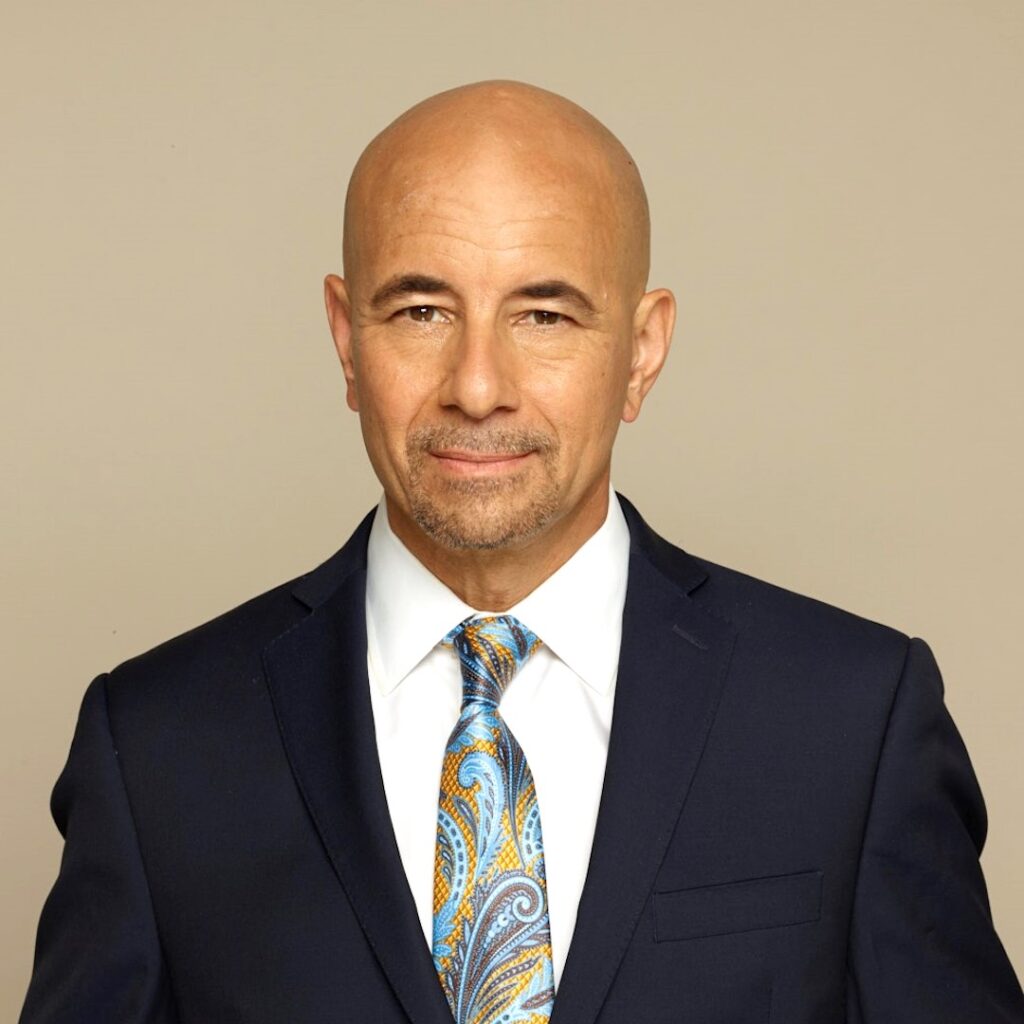

A big thank you to the SEC Small Business Capital Formation Advisory Committee for pushing this forward. Here’s their recommendation.