Impact investing is not ESG. And ESG is not Impact investing.

Is this news to you? Don’t worry, you’re not alone. Some of the smartest and most sophisticated people have trouble distinguishing between the two.

ESG stands for environmental, social and governance. It was the brainchild of governments wanting to bring these issues into mainstream investment decision-making. Impact investing, however, was born in the private sector by philanthropists and investors who wanted to put a name to investments that generated measurable social impact along with a financial return.

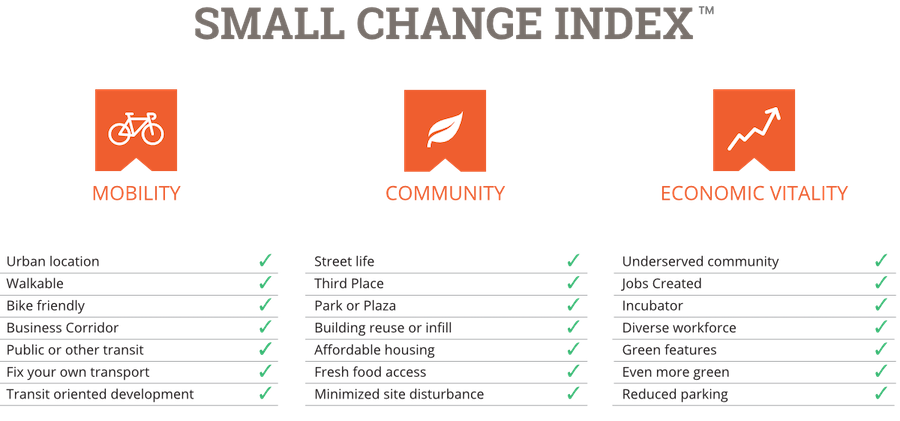

Think of ESG as a framework and impact investing as a strategy. The first focuses on integrating sustainability into existing investment strategies. The second is more hands-on, purposefully focusing on the actual impact or outcomes of a project or building. And this is what Small Change has adopted, with a purpose built impact index to measure the change that is being made.

If a building scores well in ESG, it might still make a negative impact. No weight is given to issues of the physical environment in ESG scoring. Walk score, bike score, proximity to transit are nowhere to be seen. And yet these are the things that make buildings and cities comfortable and affordable to live in.

It’s really pretty simple if you think about it.

Image courtesy of Small Change