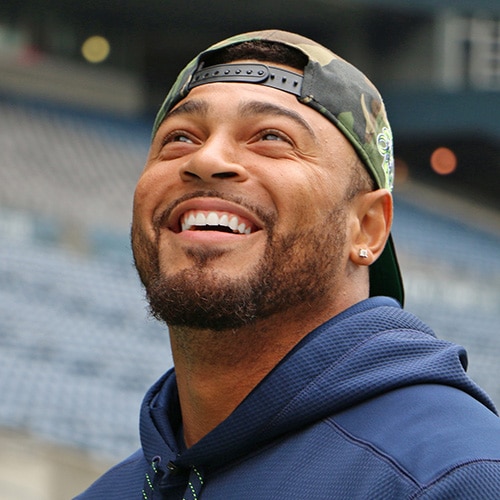

Garry Gilliam may be best known for playing in the National Football League, first for the Seattle Seahawks, then the San Francisco 49ers, but today he has a second career as an impact real estate developer. Originally from Harrisburg, at age eight Garry was sent to the Milton Hersey School, a private philanthropic boarding school for orphans and low income children based in nearby Hershey, PA, where he excelled. That model of community is one part of the inspiration for The Bridge, a new real estate development company that is working to acquire old properties like schools, malls, and warehouses, in order to turn them into sustainable communities in the inner city. Each project will be planned as self-contained, mixed-use “Eco-Villages” with housing, commercial/retail space, co-working, urban agriculture, innovation/education center and entertainment. A place to “work, eat, live, learn and play.”

The Bridge came about as a joint effort with Garry’s friends, both from Penn State and the Hershey School, to give back to their hometown community. Their first project began when they leased the Bishop McDevitt Building in Harrisburg, in 2019, to create co-working, maker and event spaces, and this summer they finished their initial fundraising. The complete rehabilitation will include about 50 units of sustainable, zero-energy housing, commercial areas and indoor urban agriculture. The Bridge also hopes to acquire five to 30 acres in Harrisburg for sustainable Eco-Village campuses that can produce healthy fresh food, clean water and renewable energy.

After starting in Harrisburg, the partners then hope to expand to other cities, going into low-income neighborhoods and turning to other athletes and influencers of color to invest in and lead each project. So … watch this space!

Insights and Inspirations

- Just watch Garry talk about The Bridge. Seriously.

- Garry wants to invest $1.5B over the next 20 years into 20 different cities with The Bridge.

- Harrisburg is ripe for impactful development with historical issues that many cities face, including redlining, neighborhoods that are food deserts, and general lack of resources for many school districts.

- The goal with The Bridge is to find a model that works not just in his hometown, but everywhere.

Information and Links

- Garry wants to highlight three amazing people: Milton Hershey, Nipsey Hussle and Charles Mully. You can read a little about each of them here.

- And he gives a shoutout to a book by spiritual teacher David Deida, The Way of the Superior Man.

Read the podcast transcript here

Eve Picker: [00:00:05] Hi there. Thanks so much for joining me today for the latest episode of Impact Real Estate Investing.

Eve: [00:00:11] My guest today is Gary Gilliam. Gary is perhaps best known for his starring role in football. He entered the NFL in 2014 after signing with the Seattle Seahawks, a superstar climax to a very long journey, which we talk about in the podcast. But today’s focus, The Bridge, came about as a joint effort with friends to give back to their hometown, Harrisburg. There they will take an obsolete school building, the Bishop McDevitt Building and repurpose it for 21st century needs. It will become an eco-village with about 50 units of sustainable, zero energy, housing, commercial uses and indoor urban agriculture. Their broader goal is to acquire five to 30 acres for sustainable eco-village campuses that will produce healthy, fresh food, clean water and renewable energy. Gary doesn’t plan to stop there. Over the next 10 years, he hopes to invest one point five billion dollars (1.5) in 20 different cities. He’ll turn to other athletes and influences of color to invest in and lead each project.

Eve: [00:01:35] Be sure to go to Evepicker.com to find out more about Gary on the show notes page for this episode and be sure to sign up for my newsletter so you can access information about impact real estate investing and get the latest news about the exciting projects on my crowdfunding platform, Small Change.

Eve: [00:01:59] All right, Gary, thanks so much for joining me on this show.

Gary Gilliam: [00:02:08] Yeah, thanks for having me.

Eve: [00:02:09] So I’m very excited to talk to you. Someone shared your really wonderful video, What is The Bridge Eco-village, with me. And there’s really there’s so much passion and love in that video. I really just wanted to hear more about the project.

Gary: [00:02:26] Yeah. Yeah, definitely. That video specifically was featuring our pilot location in Harrisburg, Pennsylvania. So, The Bridge Eco-village is a for-purpose real estate development company. The model that is also in that video is our B model in which we acquire old schools, malls, warehouses and convert them into eco-villages. And to us, an eco-village is essentially a mixed use development that has spaces for you to work, eat, live, learn and play. So that workspace, co-working spaces, maker-space, an area for entrepreneurs to come for incubation acceleration, what have you, that each branch is actually urban agriculture, the growing food with aeroponics and hydroponics, or growing food without soil, which allows us to grow food year round and also control the environment so we get bigger and higher yields and actually higher nutritional value as well. So that’s where we live is housing, affordable housing as well as luxury housing. It’s important for everybody to be together. That LERN Branch is actually our non-profit, which is Empower at the Bridge Foundation, which is a heavy focus into financial literacy, teaching people how to repair their credit. Also a heavy focus into job training, mostly like contractual work, so plumbing, electrician work, things like that, and then also sustainable business practices and research and development.

Gary: [00:03:51] Then within that play branch, the last branch is entertainment. So that’s providing a space for people to have zip lines and batting cages, electric go-carts, virtual reality areas. So providing entertainment spaces to the local community. So The Bridge Eco-village, essentially a community center or village aspect, mixed use development. The eco aspect actually comes from the way that we are building mostly through our ITW branch, but for the entire building itself. So solar panels not just looking to be net zero, but striving to be net positive in our energy. We have water collection which doubles with how efficient our water usage is within our farming aspect. We actually save ninety five percent more water than what traditional farmers do. And then within our our waste and our carbon, we actually have a bio waste food digester. We can bring in fresh food waste from outside sources, convert that into nutrients and also more energy. So not just, you know, closing the energy loop, the waste loop, the water loop, carbon loop, so building things sustainably and our build environment. But to us, it’s not just about the word sustainable. It’s really about kind of playing chess and thinking ahead and making things that are built to last. So for us, sustainability really means longevity, which is why we’re looking to convert these older good bone schools and malls and do something great with them.

Eve: [00:05:12] You have my head spinning. Any any one of these things is a pretty significant business to start. And for those who are listening, I mean, you’ve you’ve moved a career from professional football to basically community visionary. And so let’s step back a bit. I mean, how did that transformation happen and where did the seed of the idea for The Bridge begin?

Gary: [00:05:38] Way back, actually. So when I was eight years old, I actually was enrolled into a private boarding school for orphans. I’m not an orphan, so I’ll give a little bit of history about the school itself. So Milton Hershey School, founded by Hershey’s Chocolate, the great chocolate chairman Milton Hershey, not only was he into chocolate, but he also founded this school back in 1909 for little white orphan boys. It was called the Hershey Industrial School for Boys. And that’s what the school was up to the 60’s when black males were admitted, to the 70’s and 80’s females were admitted. And by the time that I went in late 90s, it was no longer just for orphans. But your family had to be below the poverty line, single parent homes, still your orphans, foster kids, the like. And what the school does is it provides a fully cost free education. You live on campus, cost free your clothes, your food, everything, and then they double it up. And when you graduate from the high school, whatever college you get accepted to, they provide you with a pretty significant scholarship, anywhere from eighty thousand to one hundred thousand dollars to go toward that education.

Eve: [00:06:47] Wow.

Gary: [00:06:48] So, that’s really the true inspiration of the work, eat, live, learn, play model. One the school, but but on a bigger scale, the town itself. So there was nothing in that farm town of Hershey wasn’t being called Hershey until Milton Hershey himself went there and established this town. Now there’s a four theme park, stadiums, theaters, obviously the entire school just it’s now a one stop shop for everything that he provided for his workers. But now it’s an entertainment space for everybody. So, that work, eat, live, learn, play model definitely comes from the town. And then also on a microcosm of the school itself, providing all the opportunities and resources that the kids needed that would have never gotten those opportunities or resources before.

Eve: [00:07:29] I bet Hershey would love to hear this story, right?

Gary: [00:07:32] Yeah, yeah.

Eve: [00:07:33] That’s a great seed to plant. So then you went on to have a professional career in football and I suppose came back to your hometown, right? That’s Harrisburg.

Gary: [00:07:45] Yeah, yeah, yeah. Yep. So I got a full ride scholarship to play at Penn State where I went and played for Joe Paterno and Bill O’Brien. While there, I triple majored in business, advertising and psychology. So made sure that with that full ride I maximize it and got some pieces of paper to my name. So then after that I went to the NFL. I went undrafted actually to the Seattle Seahawks. Earned a starting spot there and played there for three years and ended up getting two new contracts actually with the Forty Niners. And that’s who I most recently played with and now I’m a free agent. I’m taking this year off to stay away from the virus and decided to, you know, develop The Bridge. A few business plans had already been developed for The Bridge. So you kind of put them together. So, yeah, I went to the NFL, played for a few different teams, and now I’m doing some real estate development. And like you stated, you know, community development.

Eve: [00:08:38] Yes, it’s a lot of fun, isn’t it?

Gary: [00:08:40] Absolutely.

Eve: [00:08:41] Yeah. Where are you starting? Like, physically? What are the buildings like? And you have a first project, I think, in Harrisburg. What does it look like?

Gary: [00:08:50] Yeah. Yeah. So that specific property was built in 1930. It’s an old Catholic school. The Catholic school was there until 2014, so it’s been empty since then. It’s actually the fallout shelter for the city. So it’s got great bones. It’s actually really, really good shape on the inside. A few areas need some work, got to put a sprinkler system in and repair parts of the roof. That’s part of the biggest expense, aside from obviously the renovations that we plan on doing. But, yeah, that the building in terms of the areas, though, that The Bridge itself targets, there are three main requirements. First and foremost, the town or the city or the area is a food desert or within close proximity to a food desert.

Eve: [00:09:37] Um Hm.

Gary: [00:09:37] Our main objective is to convert food deserts into food oases. Food security and food localization are extremely important, not just in the health of individuals, but also in finances and keeping the dollar circulating within your community. So first and foremost, food deserts. Second, we’re targeting places that have home owner occupied rates lower than 45 percent. And then we’re also the third requirement is the local school district there is ranked in the bottom half of the state. So those three things, Venn diagramed out the middle area right there is where The Bridge wants to be. Normally areas that most developers don’t want to go into. Lots of distressed properties, you know, areas that don’t have people that have a lot of disposable income. Those are the exact people that we’re targeting. We’re pitching or constructing this model to really combat systematic oppression. Those things that I just labeled create systematic oppression and keeps whoever lives in those areas down. You don’t have resources there. You don’t have opportunities to get yourself out of those situations. So that’s right where we want to be.

Eve: [00:10:40] Ok, so this first building sounds like a gut rehab. I think I saw pictures of it. It’s pretty gorgeous on your video and it looks pretty big. How big is it and what are you planning to actually build inside that space? And you adding new buildings like I’m an architect. I want to know how the physical structure, what you’re planning.

Gary: [00:11:01] So it’s one hundred and twenty thousand square feet.

Eve: [00:11:05] Oh, that’s pretty big. Yeah.

Gary: [00:11:06] Sitting on eight and a half acres. And it’s currently there’s a ground floor, first floor and a second floor. We plan on building another floor on top, at least one floor. We’re still deciding if we’re going to go a bit higher within that top floor is going to be housing. As of now, we’ve got about 50 units. And that’s a mix of affordable housing as well as luxury housing. As I stated. In the ground floor is actually where our maker-space, music studio, a digital media lab, that’s where those those areas are. So kind of the co-working space.

Eve: [00:11:41] Incubator space.

Gary: [00:11:41] Some co-working offices up on the first floor, as well as some more housing. The gym, there’s a gym. The gym will remain the gym. There’s a nice stage in there and some built-in bleachers. So we’ll refurbish that and people will be able to use that for TED talks and what have you. We’re not going to put a gym floor back into it, but you will be able to do some physical activities in there, pull up curtains, sectioned off the area, use it for different events and what have you. There’ll be a new building actually built connected to the gym, which will house our adventure arcade. So the zip lines, the batting cages, the trampolines and what have you. So that’ll be new build as well as our farm. Which is looking to be anywhere from sixty thousand to seventy thousand square feet, but going vertical. So about six stories high, so only taken up about a third of an acre, but being able to produce the same amount of food that 13 acres does in a traditional farming sense.

Eve: [00:12:34] It sounds like your plans are pretty fleshed out. Like, how far along are you in the development process?

Gary: [00:12:39] Yeah, the conceptual phase is done. We’re getting our land development plan together. We haven’t gotten our full construction drawings together yet. We’re still locking in a few of our different anchor tenants, some of the local entities that want to be a part of our mission and really help the demographic that we’re trying to help too. So we’re making sure we lock in the right anchor tenants there and get their spaces developed the way that they like them. And as of now, we’re raising money. And luckily, being in the NFL, I got to be our main investor. But we’re in the process of opening up to bring more investors in so we can obviously bring this fully to fruition. We just had our groundbreaking actually on November 19 and looking to start construction in the spring.

Eve: [00:13:21] Oh, wow. So you’re really pretty far along.

Gary: [00:13:23] Yeah. Yeah. So we’re we’re moving along, moving, moving, moving right along. We acquired the building last November, so we took the last year to really do a lot of our planning stuff. You know, Covid slowed a few things down.

Eve: [00:13:36] Really slowed things down.

Gary: [00:13:38] Yeah. But allowed us to still meet virtually and get some of our things done.

Eve: [00:13:43] Right.

Gary: [00:13:43] But now we’re obviously entering the next phase and taking it from paper to dirt and steel. It’s going to be paramount that we get there. And so being in March, April, May it will look a little bit better.

Eve: [00:13:53] Yes, hopefully. So what do the locals think?

Gary: [00:13:56] Oh, we’ve got, oh man, tremendous community support. So, what we do, like so The Bridge Eco-village, work, eat, live, learn, play. Right. That’s that’s the model. But the specific amenities within each of those branches is determined by what the community there needs. Right. So, okay yeah, we want a co-working space, if that’s what you guys want, or we want an area like a maker-space. Like, what do you guys want within a maker-space. What do you need. What have you not had access to. You know, so we actually hold a bunch of community panels before we even put together our plan. So that’s what a lot of the last year was too, is getting in touch with local community, local neighborhoods, figuring out what the specific things people want, need, what’s lacking, obviously talking to not just the community, but also to politicians and getting their support. You know, because obviously within the fundraising aspect, there’s a public private partnership. So being able to have their support as we pursue some of those public funds was was very important, you know, and they’re all behind it. Everybody’s super behind, you know, what we’re doing. It’s not like this is some like, you know, come to Jesus thing. This is like, all right, look, we have an old school here, a building that’s been sitting here as a community. We have an opportunity now to put together a plan to really develop this thing as something that we could use and need. And not only that, but then actually create a showcase to show what other communities can do in their places and in their cities with their old buildings.

Eve: [00:15:18] You talked about public private partnerships. Does that include financing partnerships?

Gary: [00:15:23] Yeah, absolutely.

Eve: [00:15:24] So affordable housing dollars or historic tax credits?

Gary: [00:15:29] Yep.

Eve: [00:15:29] Like, how do you bring the capital stuff together? I know these projects are very difficult.

Gary: [00:15:34] Yeah, yeah. No, so a lot. So there’s different grants, obviously, like you mentioned, tax credits, historical tax credits. We actually have a meeting set up with the expert, for historical tax credits. The way we designed our plan, we know we’re not being super intrusive and knocking down a ton of different walls. So, we are anticipating…

Eve: [00:15:52] Yes, they don’t like that, do they?

Gary: [00:15:57] No, they don’t. That’s the kind of the public side, the private side, a lot of different athletes and entertainers. Right. So. As an athlete, most of us have different, like I’ll speak specifically to the NFL and football. We have our own football camps and we go back home. Right. So, it never really sat well with me, you know, just like, ah man, first of all, the chances of making it to the NFL are very, very, very low. And even if you do make it to the NFL, the chances of you keeping a lot of your money is very, very low. Eighty eight percent of NFL players are bankrupt within just two years of playing.

Eve: [00:16:29] Oh, that’s shocking.

Gary: [00:16:30] Eighty eight percent. Yeah.

Eve: [00:16:32] Why is that?

Gary: [00:16:33] That’s financial literacy and really understanding, you know, just making bad investments. I think you’ve got to have a certain image, spending the money in the wrong places, purchasing liberty.

Eve: [00:16:44] You grow up poor and then you have all this money. And because no one’s ever really taught you how to manage it, it’s too much.

Gary: [00:16:51] Yeah. Yeah. Kind of like, you know, when people win the lottery. Most of them end up same thing, either broke or dead, unfortunately.

Eve: [00:16:58] What a shame. Okay.

Gary: [00:17:00] So, aside from that, which is also an issue, instead of going home and preaching about or having the kids come in and go to these football camps, and them thinking, oh, I want to make it to the NFL and be just like Gary Gilliam, you know, if there’s a kid that that has the potential, by all means, do it. It’s also great for the physical aspect and getting the kids out of the house to do things. But let’s think a little more deeply with it. Let’s let’s really go back and talk about real estate, business, agriculture, leveraging credit. Let’s talk about those things. You can create a lot more millionaires that way than we do with athletics, right? That same drive and tenacity and execution ability that we have in athletics, we can mirror that in the business world, too. So let’s be the face of that. You know, athletes, let’s be the ones that are going back home now and using the money that we’ve gained to then, one, create opportunities for other people to gain money, but also be helping a ton of people. And most of them like it and and they want to get on board. And what The Bridge is, is it’s a model. So it’s not just in Harrisburg. We’ve got a target to hit a bunch of other cities over the next few years. So this thing is about scalability. It’s about impact. Like I stated in the very beginning, it’s a for purpose real estate development company. So really about impacting individual’s lives. But it’s also structured and made in a way that you can make a lot of money with and has a great return too.

Eve: [00:18:20] So then what will success look like to you in five or 10 years, say?

Gary: [00:18:26] Yeah, I think success will go back to our three requirements. If that area is no longer a food desert. If the home ownership are higher than forty five percent, significantly higher. And if the school district in that area is then ranked in the top half of the state, then that’s when we know we were successful. And that ripple will be able to be measured. That’s quantifiable. We’ll be able to see that with numbers. And you kind of wonder, OK, well, how does the school district, how does homeownership rates, how does that food desert, how does that relate to the bridge? Well, the school district is directly correlated to homeownership rates and values, which in our LERN branch were heavy on financial literacy, getting people into homes, using FHA loans to get their home owner occupied, taking care of properties, property values go up, more funding to our school districts. Right, these things are linked. So if we’re doing, we’re supposed to do with each bridge location and that means the area surrounding us, none of those things are now issues and we’ll see how far that ripple goes. Which will then allow us to overlap, if need be, other bridge locations so we can start to cover the areas that still have those issues.

Eve: [00:19:32] Those are really great and pragmatic metrics. I think it’ll work really well.

Gary: [00:19:38] Thank you.

Eve: [00:19:38] I have to ask, what’s the biggest challenge you’ve had with this project? Maybe you haven’t had any.

Gary: [00:19:44] The biggest challenge personally would be asking people for money. It’s kind of an odd thing personally, for me to do so, you know, getting over that hump and just kind of like, yeah, you know, this is this is kind of, you know, what we’re doing. And everyone’s always like, well, how can I get involved? It’s like, well, we need capital. That’s that’s that’s a big thing. You know, we’ve kind of assembled The Avengers. If you’ve got expertise, right, in architectural stuff or engineering or marketing or whatever else it is, like, this is obviously something that would be in a lot of different cities and teams are needed in each of those cities to run these living buildings, if you will. So, yeah. So teams and capital.

Eve: [00:20:22] Ok, and what’s your what’s your really big, hairy, audacious goal? You said you wanted to be in a few other cities in a few years. What’s, what does this look like in in 10 years from now, do you think?

Gary: [00:20:33] Oh, yeah. Oh, yeah. We’re looking to raise. You want big hairy. Okay.

Eve: [00:20:38] Yeah, Big hairy.

Gary: [00:20:39] Ok, here we go. One point five billion dollars. We want to pump that into 20 different cities over 10 years.

Eve: [00:20:50] Okay.

Gary: [00:20:50] One point five billion dollars to be deployed into 20 different cities over 10 years.

Eve: [00:20:56] That is a lot.

Gary: [00:20:59] Yeah, Big. Hairy. All that.

Eve: [00:21:01] Yeah, this is really great. Well, I’m really excited to see what what happens. I would love to be at your groundbreaking. Who knows if we’ll be through this pandemic by then. I hope I hope it’s over soon. But it really it sounds like a fantastic project. And I want to tell everyone, if they haven’t seen your video, they should go look at it because it’s a pretty wonderful description of what you’re trying to do. I really enjoyed it.

Gary: [00:21:28] Thank you.

Eve: [00:21:29] It’s been really nice talking to you.

Gary: [00:21:31] You as well. Thanks for having me.

Eve: [00:21:43] That was Gary Gilliam. Football star would probably be enough for most people. It’s not enough for Gary, who planned to leverage his extensive and influential network to do some good. To do a lot of good. The community he grew up in, Harrisburg, Pennsylvania, is poor and segregated. Gary says it is the epitome of systematic oppression, redlining, food desert, lack of resources for the school district. It’s all here. And it’s been that way since I was young. He wants to find a real solution for those real points of pain, not just in Harrisburg, but all over the world. You can find out more about impact real estate investing and access the show notes for today’s episode at my website, Evepicker.com. While you’re there, sign up for my newsletter to find out more about how to make money in real estate while building better cities. Thank you so much for spending your time with me today. And thank you, Gary, for sharing your thoughts. We’ll talk again soon. But for now, this is Eve Picker signing off to go make some change.

Image courtesy of Garry Gilliam, The Bridge.